Question: Using RIA, find the Internal Revenue Code (IRC) Section 61 defining the term gross income. Copy the first two subsections [(a) and (b)] of

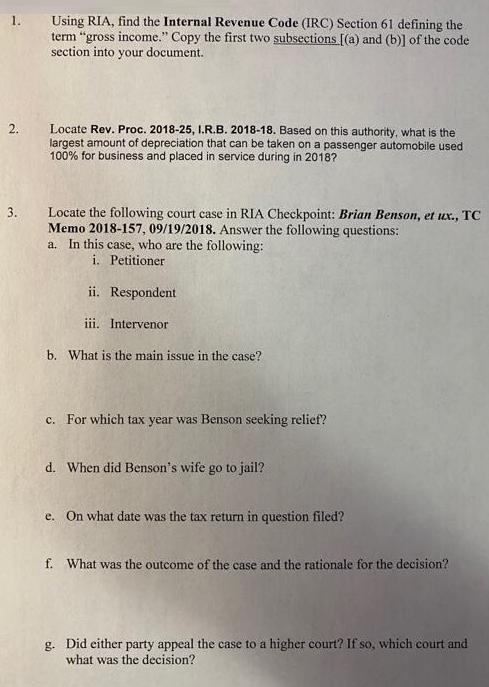

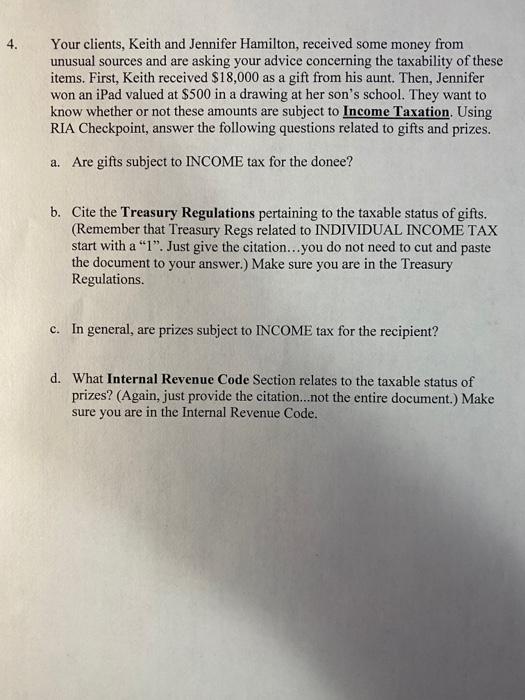

Using RIA, find the Internal Revenue Code (IRC) Section 61 defining the term "gross income." Copy the first two subsections [(a) and (b)] of the code section into your document. 1. Locate Rev. Proc. 2018-25, I.R.B. 2018-18. Based on this authority, what is the largest amount of depreciation that can be taken on a passenger automobile used 100% for business and placed in service during in 2018? 2. Locate the following court case in RIA Checkpoint: Brian Benson, et ux., TC Memo 2018-157, 09/19/2018. Answer the following questions: a. In this case, who are the following: i. Petitioner 3. ii. Respondent iii. Intervenor b. What is the main issue in the case? c. For which tax year was Benson seeking relief? d. When did Benson's wife go to jail? e. On what date was the tax return in question filed? f. What was the outcome of the case and the rationale for the decision? g. Did either party appeal the case to a higher court? If so, which court and what was the decision? Your clients, Keith and Jennifer Hamilton, received some money from unusual sources and are asking your advice concerning the taxability of these items. First, Keith received $18,000 as a gift from his aunt. Then, Jennifer won an iPad valued at $500 in a drawing at her son's school. They want to know whether or not these amounts are subject to Income Taxation. Using RIA Checkpoint, answer the following questions related to gifts and prizes. 4. a. Are gifts subject to INCOME tax for the donee? b. Cite the Treasury Regulations pertaining to the taxable status of gifts. (Remember that Treasury Regs related to INDIVIDUAL INCOME TAX start with a "1". Just give the citation...you do not need to cut and paste the document to your answer.) Make sure you are in the Treasury Regulations. c. In general, are prizes subject to INCOME tax for the recipient? d. What Internal Revenue Code Section relates to the taxable status of prizes? (Again, just provide the citation...not the entire document.) Make sure you are in the Internal Revenue Code.

Step by Step Solution

There are 3 Steps involved in it

1 26 US Code 61 defined Gross income IRC 61a General Definition Except as otherwise provided in this subtitle gross income means all income from whate... View full answer

Get step-by-step solutions from verified subject matter experts