Question: Rich Mnizi ( Pty ) Ltd ( hereafter RM ) is a well - established company that manufactures trendy fashionable clothing, including both

Rich Mnizi Pty Ltd hereafter RM is a wellestablished company that manufactures trendy fashionable clothing, including both a women's and men's range, to be sold at a local market that is open every Saturday in Braamfontein. RM has a April yearend.

The company has become increasingly aware of their need to align the company values with good corporate governance and social development. As a result of this, RM has a long standing agreement with Oceana Clothing Pty Ltd hereafter OC a charity shop, to provide any unsold stock at the end of the season at a discount. The sale to OC occurs at the beginning of the next season.

OC is extremely reliant on the proceeds from the sale of RM products because the brand name is so popular and stock can be sold at a reasonable price. On May RM signed the annual sales agreement with OC that stipulated that RM will sell to OC any unsold stock at of its original cost. In the event that the total sale proceeds of the inventory sold to OC is less than R RM agreed to donate the difference in cash to the orphanage that OC supports.

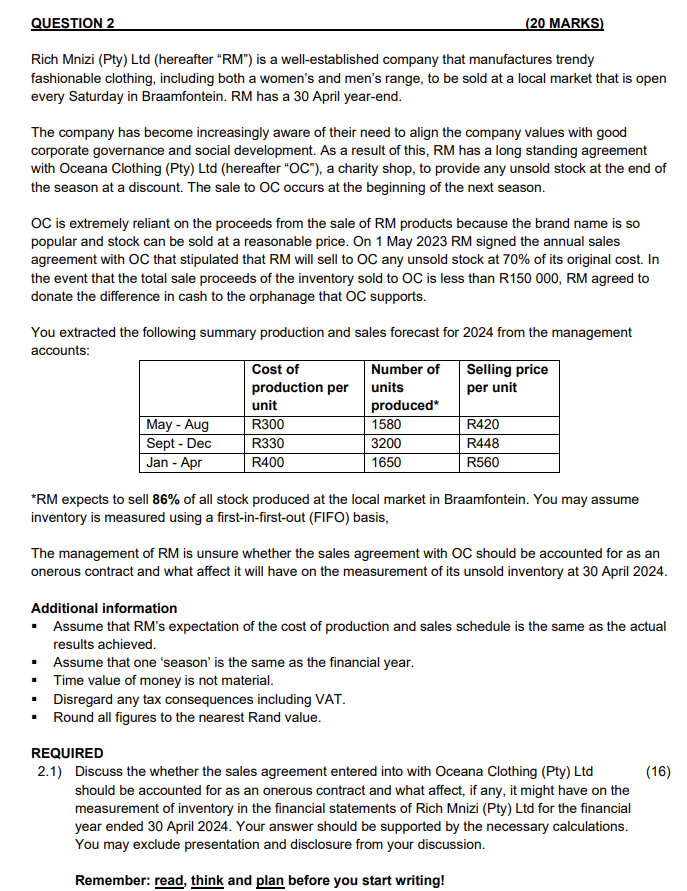

You extracted the following summary production and sales forecast for from the management accounts:

RM expects to sell mathbf of all stock produced at the local market in Braamfontein. You may assume inventory is measured using a firstinfirstout FIFO basis,

The management of RM is unsure whether the sales agreement with OC should be accounted for as an onerous contract and what affect it will have on the measurement of its unsold inventory at April

Additional information

Assume that RMs expectation of the cost of production and sales schedule is the same as the actual results achieved.

Assume that one 'season' is the same as the financial year.

Time value of money is not material.

Disregard any tax consequences including VAT.

Round all figures to the nearest Rand value.

REQUIRED

Discuss the whether the sales agreement entered into with Oceana Clothing Pty Ltd

should be accounted for as an onerous contract and what affect, if any, it might have on the measurement of inventory in the financial statements of Rich Mnizi Pty Ltd for the financial year ended April Your answer should be supported by the necessary calculations. You may exclude presentation and disclosure from your discussion.

Remember: read, think and plan before you start writing!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock