Question: Rick's projected tax liability for the current year is $34,500. Although Rick has substantial dividend and interest income, he does not pay any estimated taxes.

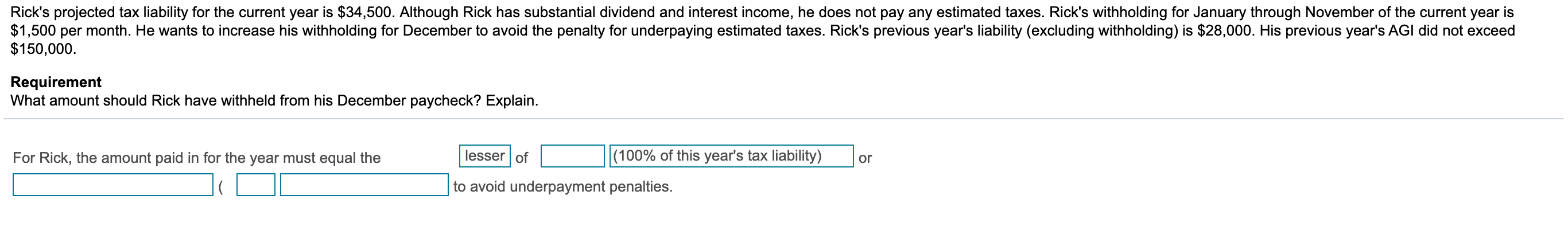

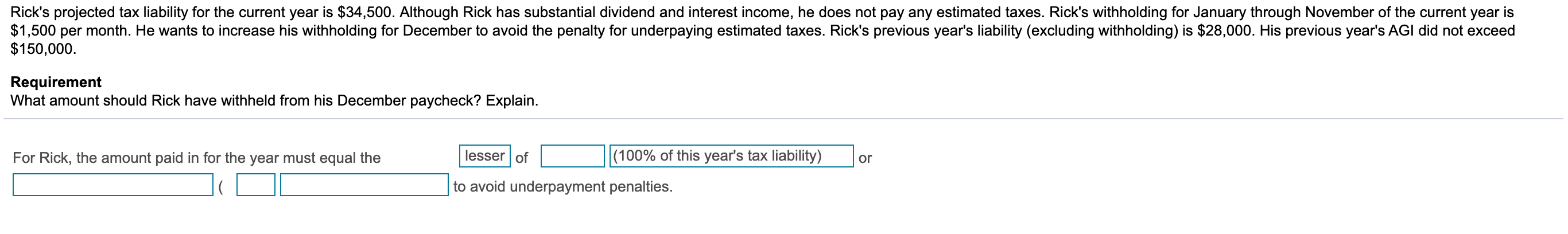

Rick's projected tax liability for the current year is $34,500. Although Rick has substantial dividend and interest income, he does not pay any estimated taxes. Rick's withholding for January through November of the current year is $1,500 per month. He wants to increase his withholding for December to avoid the penalty for underpaying estimated taxes. Rick's previous year's liability (excluding withholding) is $28,000. His previous year's AGI did not exceed $150,000. Requirement What amount should Rick have withheld from his December paycheck? Explain. For Rick, the amount paid in for the year must equal the lesser of (100% of this year's tax liability) or to avoid underpayment penalties

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts