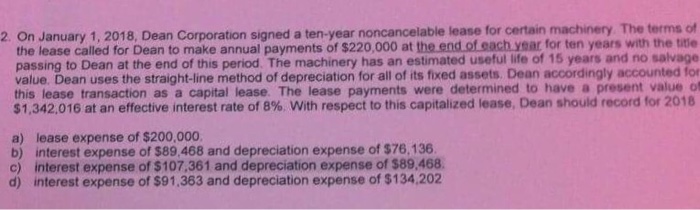

Question: Right answer is C. Please I need the solution On January 1, 2018, Dean Corporation signed a ten-year noncancelable lease for certain machinery. The terms

On January 1, 2018, Dean Corporation signed a ten-year noncancelable lease for certain machinery. The terms of the lease called for Dean to make annual payments of exist220,000 at the end of each year for ten years with the title passing to Dean at the end of this period. The machinery has an estimated useful life of 15 years and no salvage value. Dean uses the straight-line method of depreciation for all of its fixed assets. Dean accordingly accounted for this lease transaction as a capital lease. The lease payments were determined to have a present value of exist1, 342, 016 at an effective interest rate of 8%. With respect to this capitalized lease. Dean should record for 2018 a) lease expense of exist200,000. b) interest expense of exist89, 468 and depreciation expense of exist76, 136. c) Interest expense of exist107, 361 and depreciation expense of exist89, 468. d) interest expense of exist91, 363 and depreciation expense of exist134, 202

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts