Question: right answer please Gurung Co. has a noncontributory, defined benefit pension plan adopted on 1 January 20X5. On 31 December 20X5, the following information is

right answer please

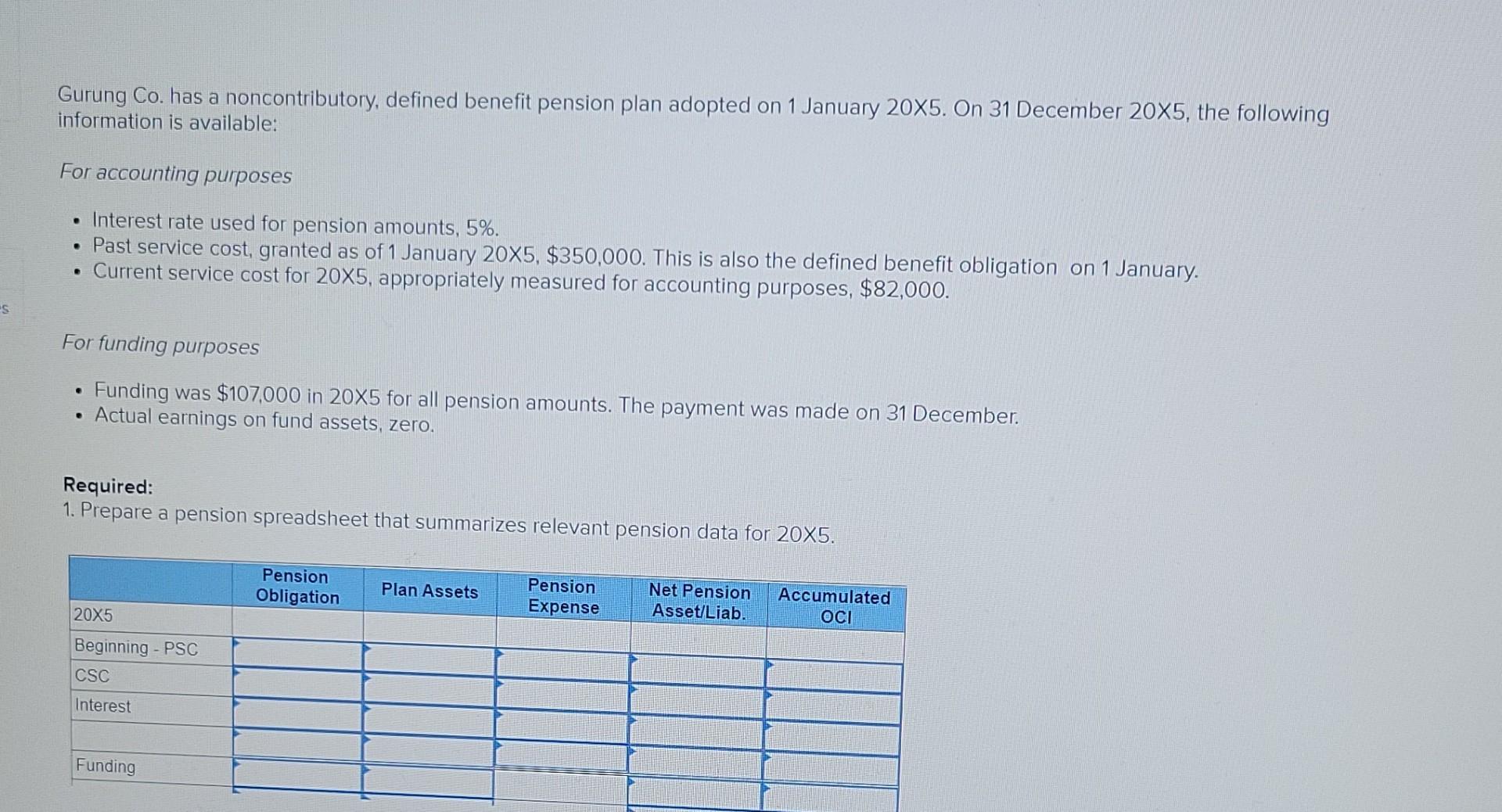

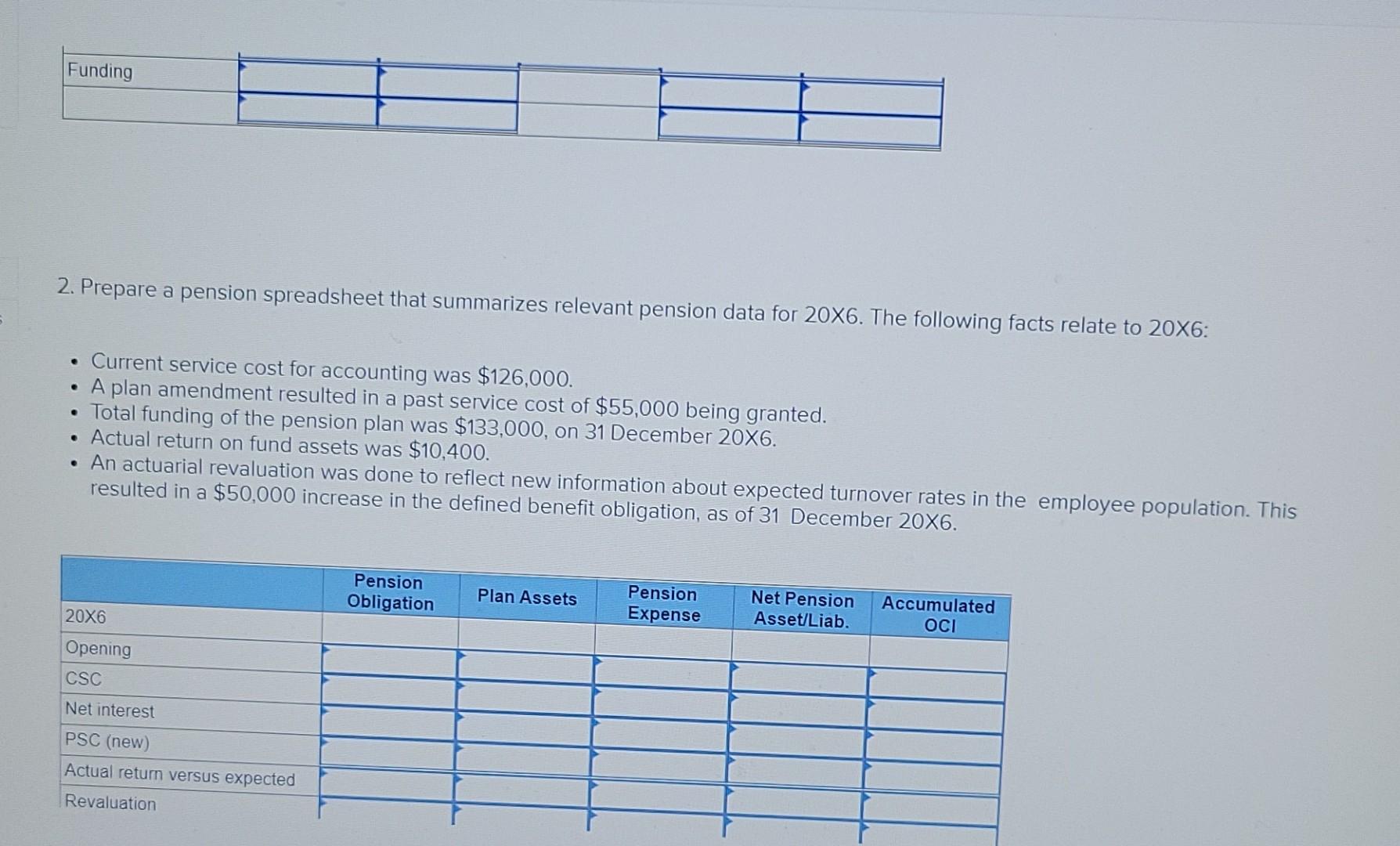

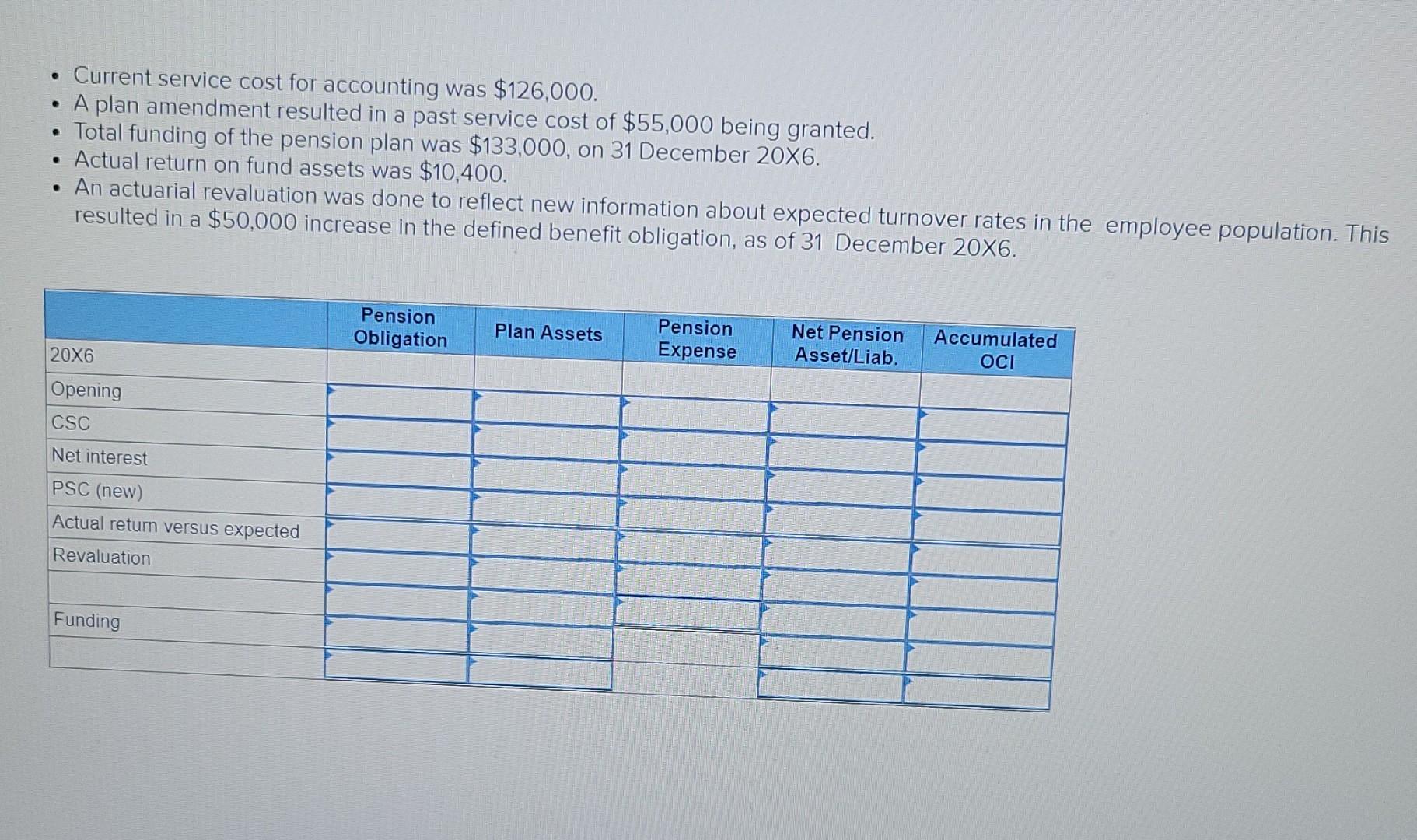

Gurung Co. has a noncontributory, defined benefit pension plan adopted on 1 January 20X5. On 31 December 20X5, the following information is available: For accounting purposes . Interest rate used for pension amounts, 5%. Past service cost, granted as of 1 January 20X5, $350,000. This is also the defined benefit obligation on 1 January. Current service cost for 20X5, appropriately measured for accounting purposes, $82,000. . s For funding purposes Funding was $107.000 in 20X5 for all pension amounts. The payment was made on 31 December Actual earnings on fund assets, zero. Required: 1. Prepare a pension spreadsheet that summarizes relevant pension data for 20X5. Pension Obligation Plan Assets Pension Expense Net Pension Asset/Liab. Accumulated 20X5 OCI Beginning - PSC CSC Interest Funding Funding 2. Prepare a pension spreadsheet that summarizes relevant pension data for 20X6. The following facts relate to 20x6: . Current service cost for accounting was $126,000. A plan amendment resulted in a past service cost of $55,000 being granted. Total funding of the pension plan was $133,000, on 31 December 20X6. Actual return on fund assets was $10,400. An actuarial revaluation was done to reflect new information about expected turnover rates in the employee population. This resulted in a $50,000 increase in the defined benefit obligation, as of 31 December 20X6. Pension Obligation Plan Assets Pension Expense 20X6 Net Pension Asset/Liab. Accumulated Opening CSC Net interest PSC (new) Actual retum versus expected Revaluation e Current service cost for accounting was $126,000. A plan amendment resulted in a past service cost of $55,000 being granted. Total funding of the pension plan was $133,000, on 31 December 20X6. Actual return on fund assets was $10,400. An actuarial revaluation was done to reflect new information about expected turnover rates in the employee population. This resulted in a $50,000 increase in the defined benefit obligation, as of 31 December 20X6. Pension Obligation Plan Assets Pension Expense Net Pension Asset/Liab. 20X6 Accumulated OCI Opening CSC Net interest PSC (new) Actual return versus expected Revaluation Funding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts