Question: Right before his death from a terminal illness, Shing makes a gift of $890,000 cash that he had planned to bequeath to the church anyway.

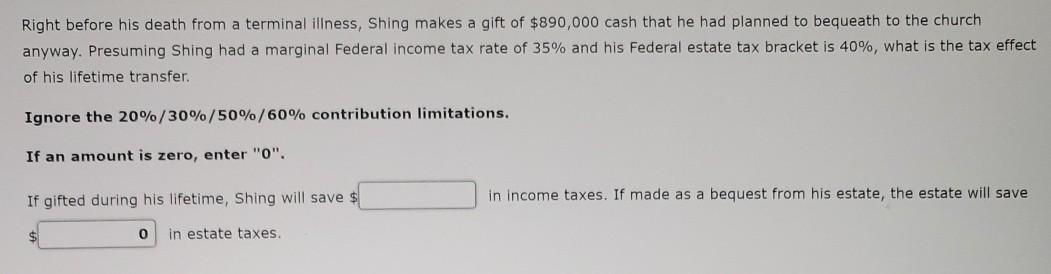

Right before his death from a terminal illness, Shing makes a gift of $890,000 cash that he had planned to bequeath to the church anyway. Presuming Shing had a marginal Federal income tax rate of 35% and his Federal estate tax bracket is 40%, what is the tax effect of his lifetime transfer. Ignore the 20%/30%/50%/60% contribution limitations. If an amount is zero, enter "O". If gifted during his lifetime, Shing will save $ in income taxes. If made as a bequest from his estate, the estate will save 0 in estate taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts