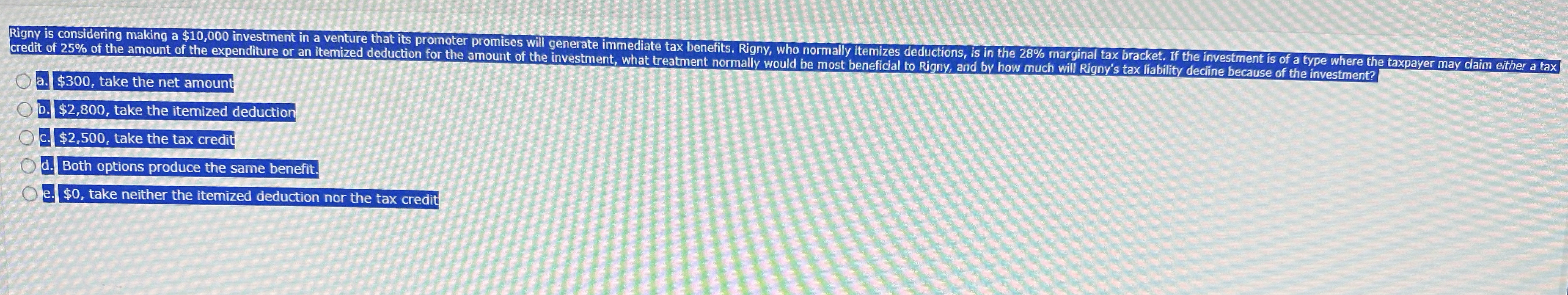

Question: Rigny is considering making a $ 1 0 , 0 0 0 investment in a venture that its promoter promises will generate immediate tax benefits.

Rigny is considering making a $ investment in a venture that its promoter promises will generate immediate tax benefits. Rigny, who normally itemizes deductions, is in the marginal tax bracket. If the investment is of a type where the taxpayer may claim either a tax cedit of of the amount of the expenditure or an itemized deduction for the amount of the investment, what treatment normally would be most beneficial to Rigny, and by how much will Rigny's tax liability decline because of the investiment?

$ take the net amount

$ $ take the itemized deduction

$ take the tax credilt

Both options produce the same benefit.

$ take neither the itemized deduction nor the tax credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock