Question: ring Enabled: Midterm Exam 2 : Section A ( i ) During 2 0 2 3 , Fresh Express Company sold 2 . 2 5

ring Enabled: Midterm Exam : Section A i

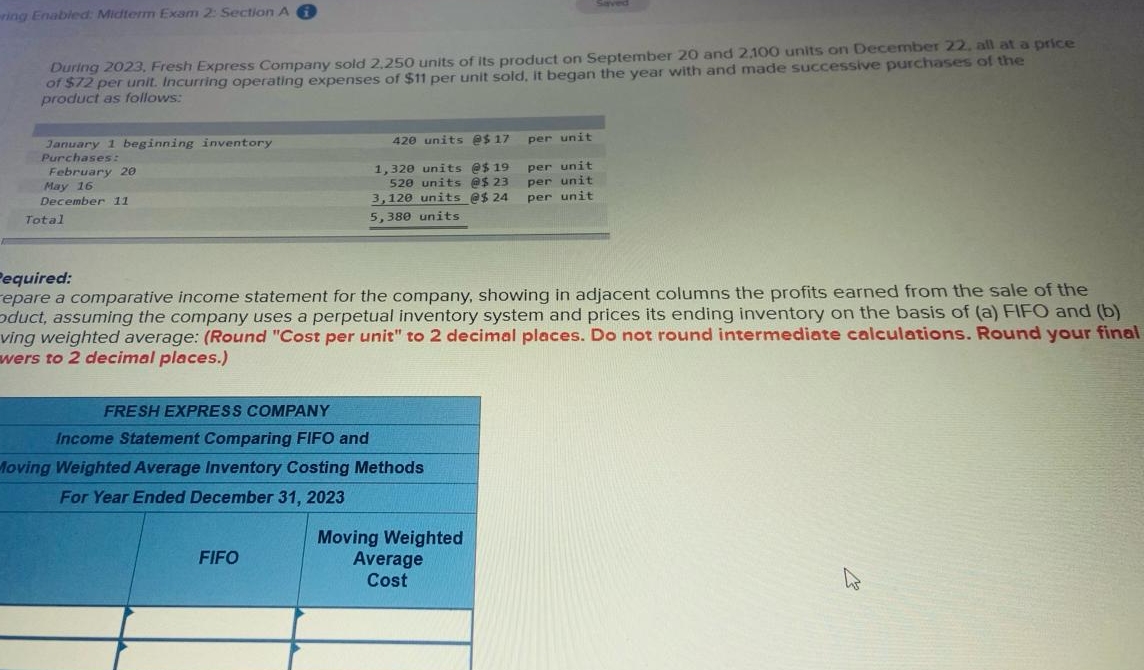

During Fresh Express Company sold units of its product on September and units on December all at a price of $ per unit. Incurring operating expenses of $ per unit sold, it began the year with and made successive purchases of the product as follows:

tabletableJanuary beginning inventoryPurchases: units,e$ per unitFebruary units,e$ $per unitMay units,o $per unitDecember units,e $per unitTotal units,,

equired:

epare a comparative income statement for the company, showing in adjacent columns the profits earned from the sale of the oduct, assuming the company uses a perpetual inventory system and prices its ending inventory on the basis of a FIFO and b ving weighted average: Round "Cost per unit" to decimal places. Do not round intermediate calculations. Round your final wers to decimal places.

FRESH EXPRESS COMPANY

Income Statement Comparing FIFO and

loving Weighted Average Inventory Costing Methods

For Year Ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock