Question: Rio Limited ( Rio ) is a foreign corporation that manufactures widgets and resides in Country Y . Rio also manufactures widgets in

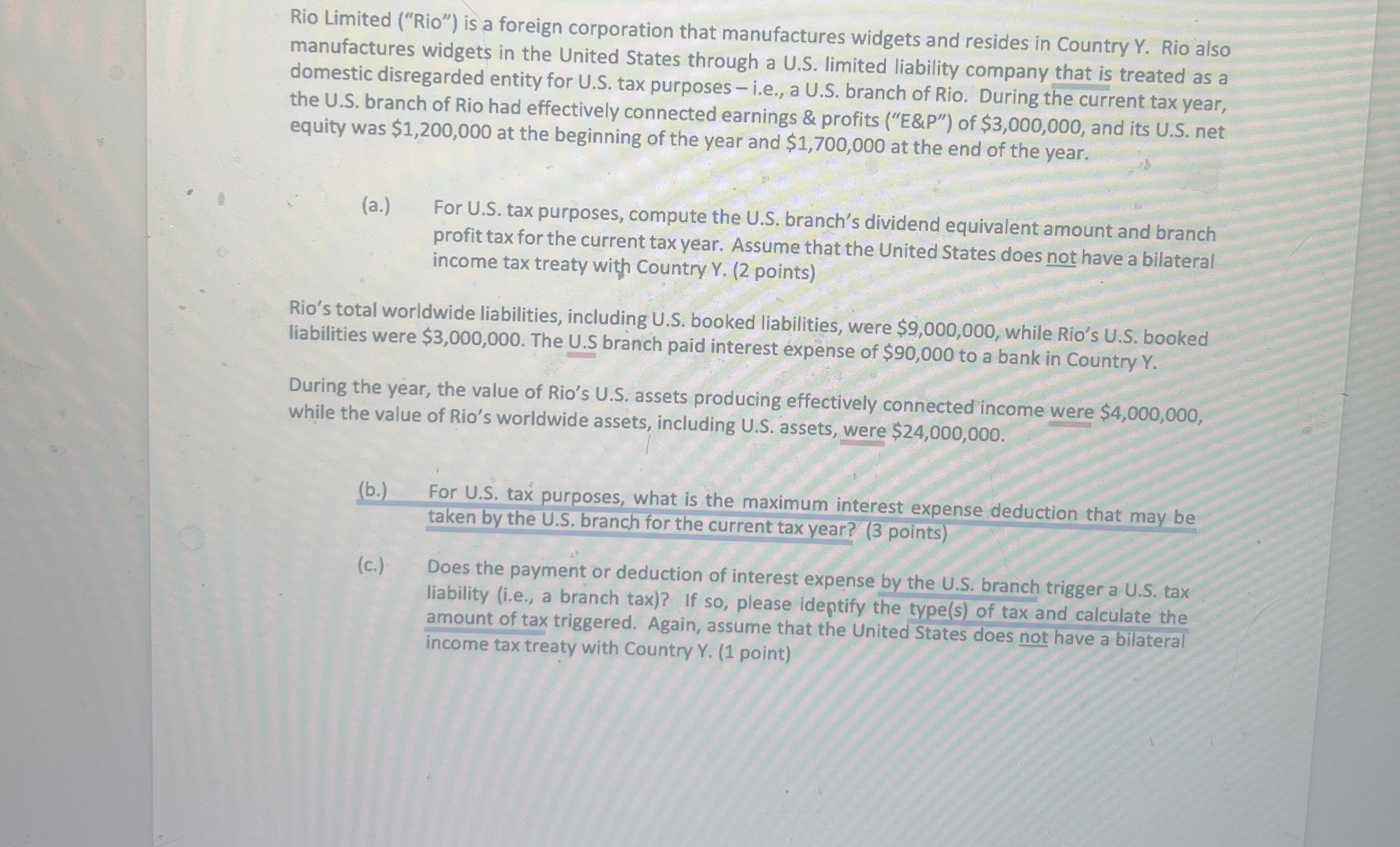

Rio Limited Rio is a foreign corporation that manufactures widgets and resides in Country Y Rio also manufactures widgets in the United States through a US limited liability company that is treated as a domestic disregarded entity for US tax purposes ie a US branch of Rio. During the current tax year, the US branch of Rio had effectively connected earnings & profits E&P of $ and its US net equity was $ at the beginning of the year and $ at the end of the year.

a For US tax purposes, compute the US branch's dividend equivalent amount and branch profit tax for the current tax year. Assume that the United States does not have a bilateral income tax treaty with Country Y points

Rio's total worldwide liabilities, including US booked liabilities, were $ while Rio's US booked liabilities were $ The US branch paid interest expense of $ to a bank in Country

During the year, the value of Rio's US assets producing effectively connected income were $ while the value of Rio's worldwide assets, including US assets, were $

b For US tax purposes, what is the maximum interest expense deduction that may be taken by the US branch for the current tax year? points

c Does the payment or deduction of interest expense by the US branch trigger a US tax liability ie a branch tax If so please ideptify the types of tax and calculate the amount of tax triggered. Again, assume that the United States does not have a bilateral income tax treaty with Country Y point

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock