Question: ( Risk - adjusted discount rates and risk classes ) The G . Wolfe Corporation is examining two capital - budgeting projects with 5 -

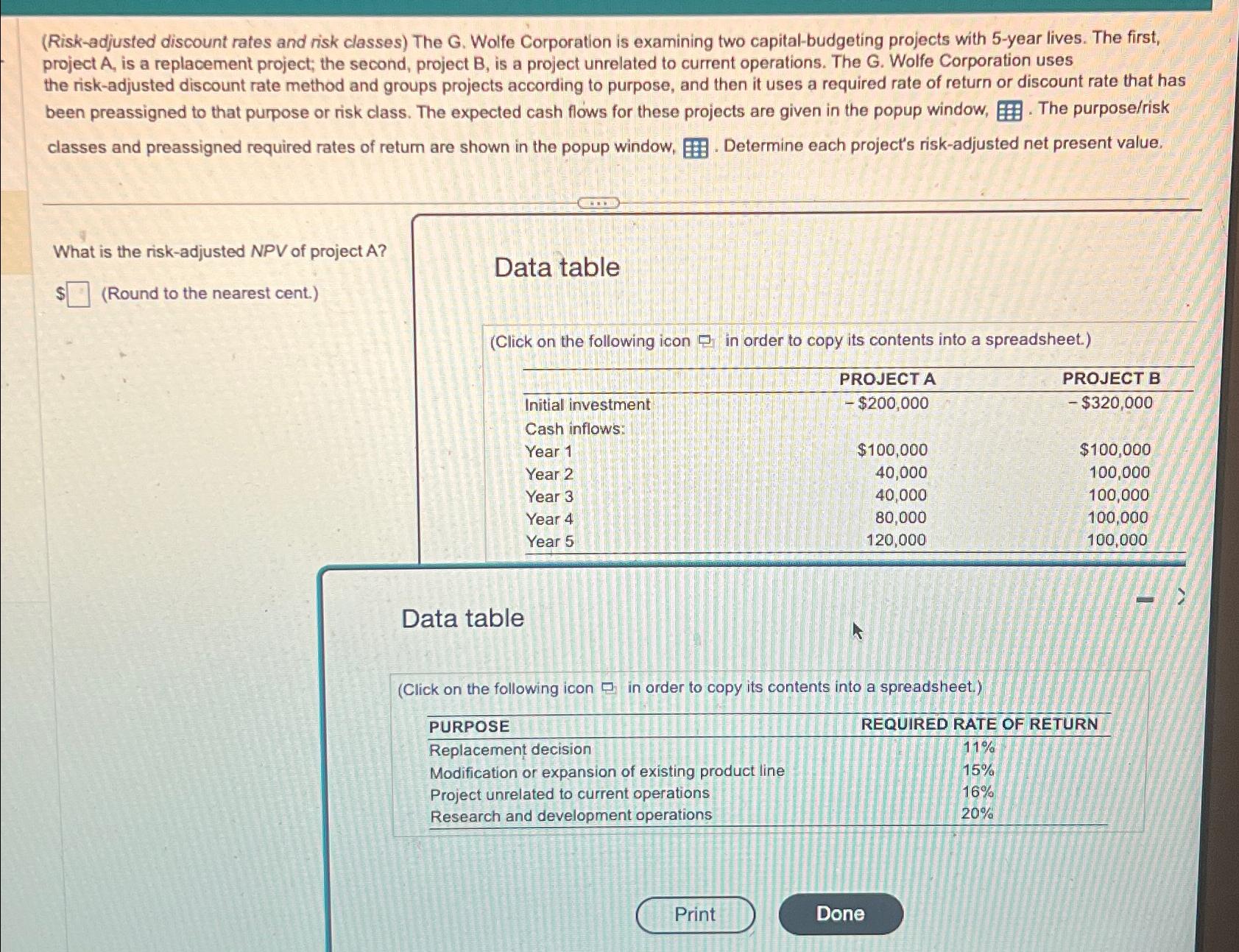

Riskadjusted discount rates and risk classes The G Wolfe Corporation is examining two capitalbudgeting projects with year lives. The first, project is a replacement project; the second, project is a project unrelated to current operations. The G Wolfe Corporation uses the riskadjusted discount rate method and groups projects according to purpose, and then it uses a required rate of return or discount rate that has been preassigned to that purpose or risk class. The expected cash flows for these projects are given in the popup window, The purposerisk classes and preassigned required rates of return are shown in the popup window, Determine each project's riskadjusted net present value.

What is the riskadjusted NPV of project A

$ Round to the nearest cent.

Data table

Click on the following icon in order to copy its contents into a spreadsheet.

tablePROJECT APROJECT BInitial investment,$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock