Question: Risk and Return Graded Assignment | Read Chapter 6 | Back to Assignment Due Wednosday 06.2748 at 114 Attempts Do No Harm: 14 11. Portfolio

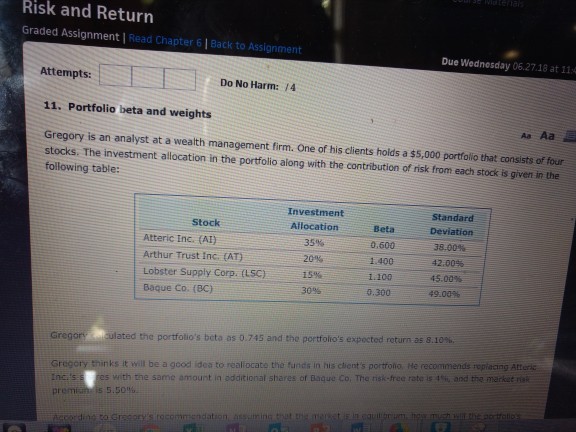

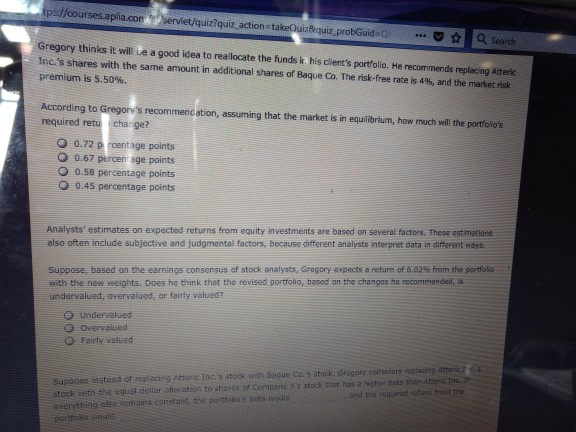

Risk and Return Graded Assignment | Read Chapter 6 | Back to Assignment Due Wednosday 06.2748 at 114 Attempts Do No Harm: 14 11. Portfolio beta and weights Aa Aa Gregory is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Investment Allocation 35% 20% 15% 30% Beta 0.600 1.400 1 100 0.300 Standard Deviation 38.00% 42.00% 45,00% 49.00% Stock Atteric InC (AI) Arthur Trust Inc. (AT) Lobster Supply Corp. (LSC) Baque Co. (BC) Gregor ulated the portfolio's beta as 0.745 and the portfolio's expected return as 8.10% Gregory thinks it will be a good ides to reallocate the funds in his client's portrollo, He recommends roplacing Atteric Inci's s res with tne same amount in additional shares of Baque Co. The risk-free rate is 4%, and the market no prem 5.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts