Question: Risk and Return: Stand - Alone Risk Stand - alone risk is the risk an investor would face if he or she held only .

Risk and Return: StandAlone Risk

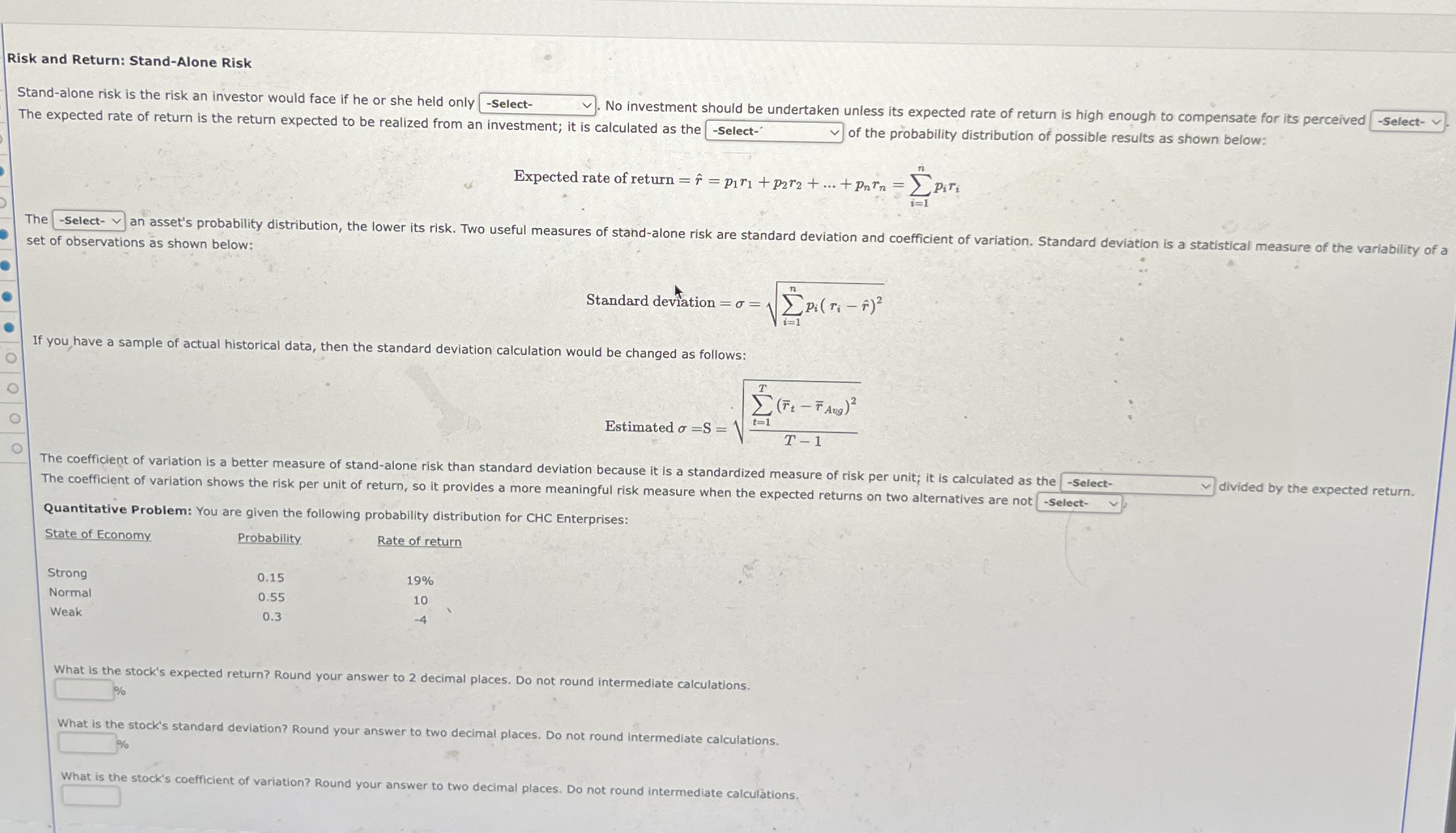

Standalone risk is the risk an investor would face if he or she held only No investment should be undertaken unless its expected rate of return is high enough to compensate for its perceived The expected rate of return is the return expected to be realized from an investment; it is calculated as th of the probability distribution of possible results as shown below:

Expected rate return hatdots

The an asset's probability distribution, the lower its risk. Two useful measures of standalone risk are standard deviation and coefficient of variation. Standard deviation is a statistical measure of the variability of a set of observations as shown below:

Standard deviation

If you have a sample of actual historical data, then the standard deviation calculation would be changed as follows:

Estimated

The coefficient of variation is a better measure of standalone risk than standard deviation because it is a standardized measure of risk per unit; it is calculated as the The coefficient of variation shows the risk per unit of return, so it provides a more meaningful risk measure when the expected returns on two alternatives are not divided by the expected return.

Quantitative Problem: You are given the following probability distribution for CHC Enterprises:

Rate of return

Strong

Normal

Weak

What is the stock's expected return? Round your answer to decimal places. Do not round intermediate calculations.

What is the stock's standard deviation? Round your answer to two decimal places. Do not round intermediate calculations.

What is the stock's coefficient of variation? Round your answer to two decimal places. Do not round intermediate calcultions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock