Question: Risk assessment Senior management is concerned about the recent developments in the financial markets. There is a general belief that market volatility has been relatively

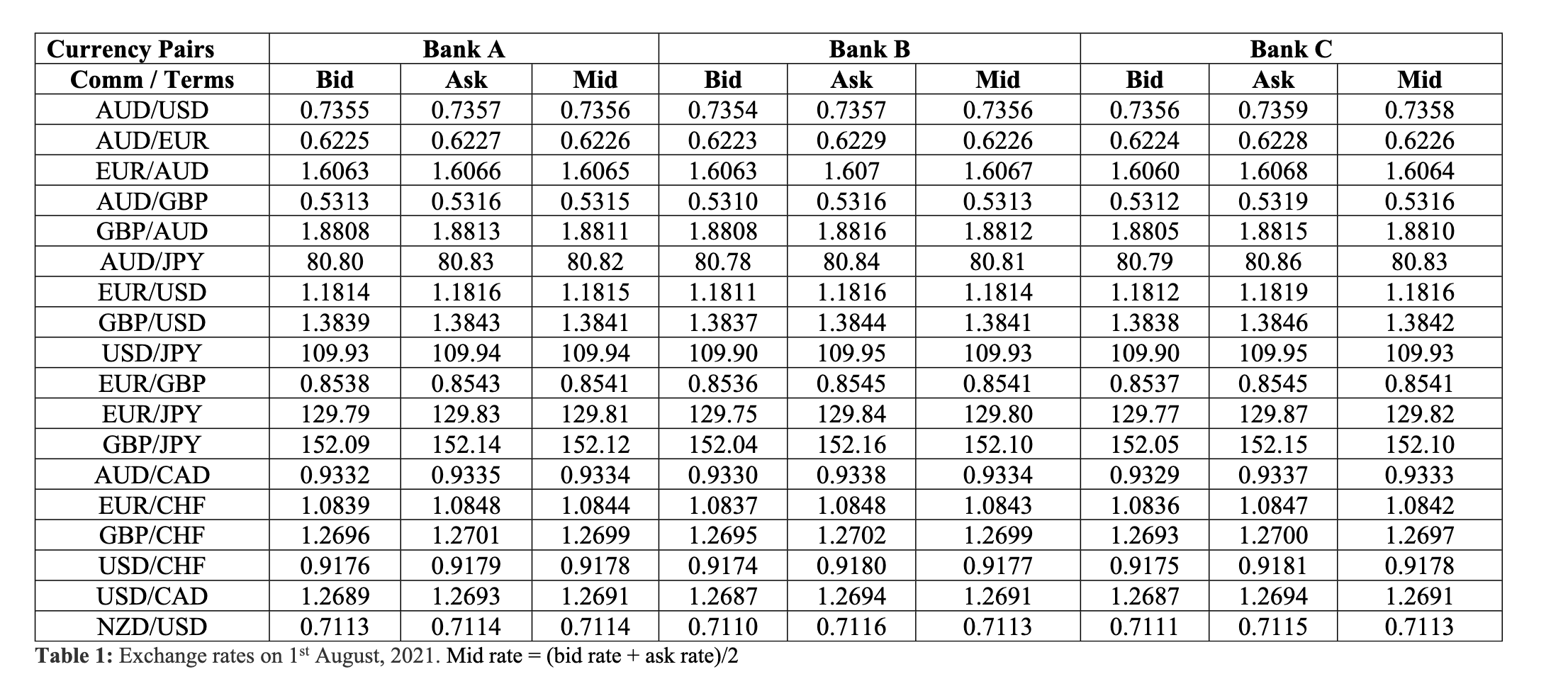

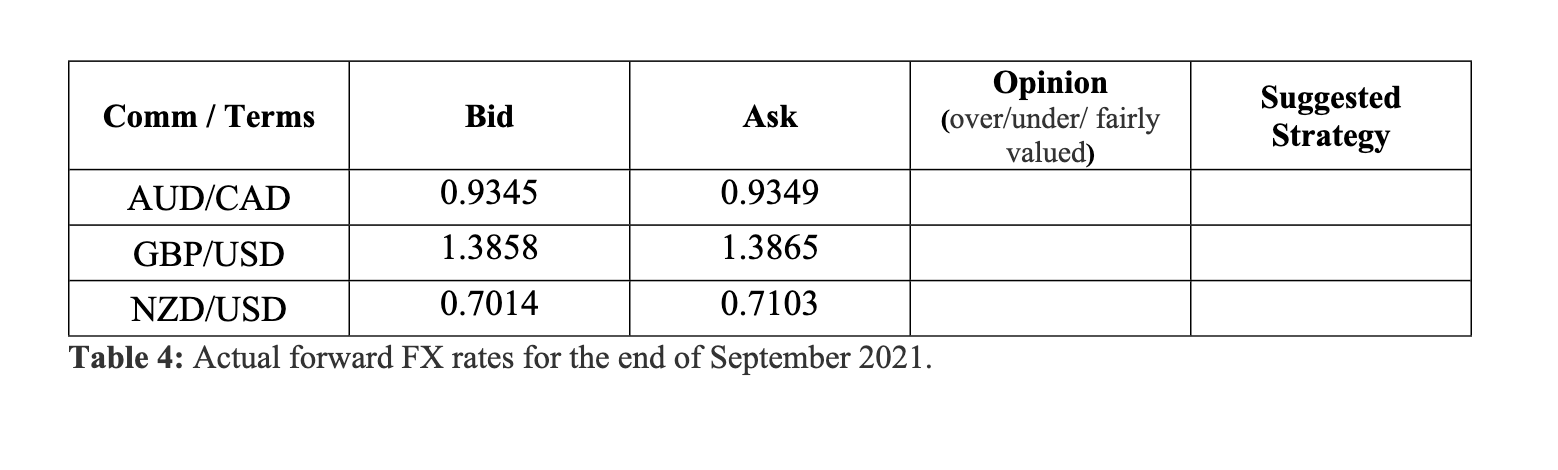

Risk assessment Senior management is concerned about the recent developments in the financial markets. There is a general belief that market volatility has been relatively high, yet it might climb even higher than expected in the near future due to the current global health crisis. You have been asked to conduct a thorough risk assessment of your speculative positions undertaken in scenario For this purpose, the firms foreign currency analyst has provided you with the 2-month benchmark rates of these major currencies. 1.Using the interest rates in Table 3, calculate the implied forward bid, ask and mid rates for the two currency pairs (cad/aud and gbp/usd) [1 Marks].

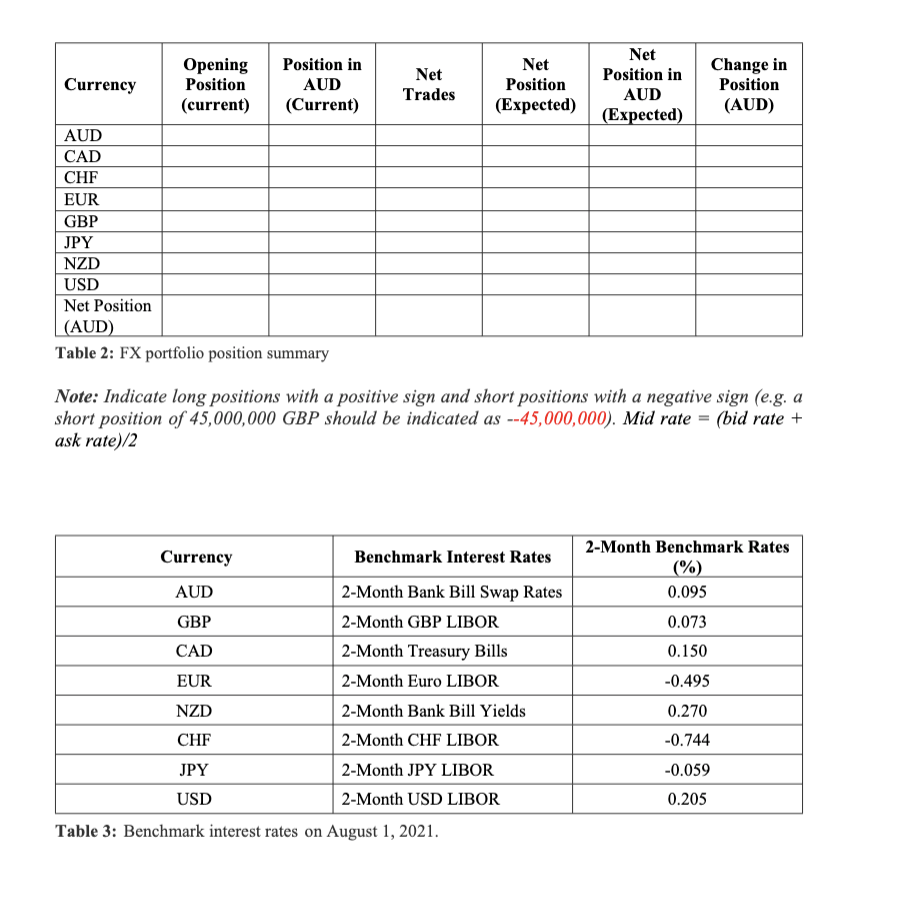

2.You must then calculate the value of your FX portfolio at the end of September using the calculated bid/ask rates. Report the expected value of your position in each currency in the position summary in Table 2 [2 Marks].

3.Finally, you must calculate expected profit/loss (gain or loss over the opening position) on your portfolio in AUD [1 Mark]. The AUD value of the net expected position must be calculated using the estimated mid rates.

could you pls answer question by question numbering them.

and pls show the work out too.

Thanks.

Net Trades Net Position (Expected) Net Position in AUD (Expected) Change in Position (AUD) Opening Position in Currency Position AUD (current) (Current) AUD CAD CHF EUR GBP JPY NZD USD Net Position (AUD) Table 2: FX portfolio position summary Note: Indicate long positions with a positive sign and short positions with a negative sign (e.g. a short position of 45,000,000 GBP should be indicated as --45,000,000). Mid rate = (bid rate + ask rate)/2 2-Month Benchmark Rates (%) 0.095 0.073 0.150 -0.495 Currency Benchmark Interest Rates AUD 2-Month Bank Bill Swap Rates GBP 2-Month GBP LIBOR CAD 2-Month Treasury Bills EUR 2-Month Euro LIBOR NZD 2-Month Bank Bill Yields CHF 2-Month CHF LIBOR JPY 2-Month JPY LIBOR USD 2-Month USD LIBOR Table 3: Benchmark interest rates on August 1, 2021. 0.270 -0.744 -0.059 0.205 Currency Pairs Bank A Comm / Terms Bid Ask Mid Bid AUD/USD 0.7355 0.7357 0.7356 0.7354 AUD/EUR 0.6225 0.6227 0.6226 0.6223 EUR/AUD 1.6063 1.6066 1.6065 1.6063 AUD/GBP 0.5313 0.5316 0.5315 0.5310 GBP/AUD 1.8808 1.8813 1.8811 1.8808 AUD/JPY 80.80 80.83 80.82 80.78 EUR/USD 1.1814 1.1816 1.1815 1.1811 GBP/USD 1.3839 1.3843 1.3841 1.3837 USD/JPY 109.93 109.94 109.94 109.90 EUR/GBP 0.8538 0.8543 0.8541 0.8536 EUR/JPY 129.79 129.83 129.81 129.75 GBP/JPY 152.09 152.14 152.12 152.04 AUD/CAD 0.9332 0.9335 0.9334 0.9330 EUR/CHF 1.0839 1.0848 1.0844 1.0837 GBP/CHF 1.2696 1.2701 1.2699 1.2695 USD/CHF 0.9176 0.9179 0.9178 0.9174 USD/CAD 1.2689 1.2693 1.2691 1.2687 NZD/USD 0.7113 0.7114 0.7114 0.7110 Table 1: Exchange rates on 1st August, 2021. Mid rate = (bid rate + ask rate)/2 Bank B Ask 0.7357 0.6229 1.607 0.5316 1.8816 80.84 1.1816 1.3844 109.95 0.8545 129.84 152.16 0.9338 1.0848 1.2702 0.9180 1.2694 0.7116 Mid 0.7356 0.6226 1.6067 0.5313 1.8812 80.81 1.1814 1.3841 109.93 0.8541 129.80 152.10 0.9334 1.0843 1.2699 0.9177 1.2691 0.7113 Bid 0.7356 0.6224 1.6060 0.5312 1.8805 80.79 1.1812 1.3838 109.90 0.8537 129.77 152.05 0.9329 1.0836 1.2693 0.9175 1.2687 0.7111 Bank C Ask 0.7359 0.6228 1.6068 0.5319 1.8815 80.86 1.1819 1.3846 109.95 0.8545 129.87 152.15 0.9337 1.0847 1.2700 0.9181 1.2694 0.7115 Mid 0.7358 0.6226 1.6064 0.5316 1.8810 80.83 1.1816 1.3842 109.93 0.8541 129.82 152.10 0.9333 1.0842 1.2697 0.9178 1.2691 0.7113 Suggested Strategy Opinion Comm/ Terms Bid Ask (over/under/ fairly valued) AUD/CAD 0.9345 0.9349 GBP/USD 1.3858 1.3865 NZD/USD 0.7014 0.7103 Table 4: Actual forward FX rates for the end of September 2021. Net Trades Net Position (Expected) Net Position in AUD (Expected) Change in Position (AUD) Opening Position in Currency Position AUD (current) (Current) AUD CAD CHF EUR GBP JPY NZD USD Net Position (AUD) Table 2: FX portfolio position summary Note: Indicate long positions with a positive sign and short positions with a negative sign (e.g. a short position of 45,000,000 GBP should be indicated as --45,000,000). Mid rate = (bid rate + ask rate)/2 2-Month Benchmark Rates (%) 0.095 0.073 0.150 -0.495 Currency Benchmark Interest Rates AUD 2-Month Bank Bill Swap Rates GBP 2-Month GBP LIBOR CAD 2-Month Treasury Bills EUR 2-Month Euro LIBOR NZD 2-Month Bank Bill Yields CHF 2-Month CHF LIBOR JPY 2-Month JPY LIBOR USD 2-Month USD LIBOR Table 3: Benchmark interest rates on August 1, 2021. 0.270 -0.744 -0.059 0.205 Currency Pairs Bank A Comm / Terms Bid Ask Mid Bid AUD/USD 0.7355 0.7357 0.7356 0.7354 AUD/EUR 0.6225 0.6227 0.6226 0.6223 EUR/AUD 1.6063 1.6066 1.6065 1.6063 AUD/GBP 0.5313 0.5316 0.5315 0.5310 GBP/AUD 1.8808 1.8813 1.8811 1.8808 AUD/JPY 80.80 80.83 80.82 80.78 EUR/USD 1.1814 1.1816 1.1815 1.1811 GBP/USD 1.3839 1.3843 1.3841 1.3837 USD/JPY 109.93 109.94 109.94 109.90 EUR/GBP 0.8538 0.8543 0.8541 0.8536 EUR/JPY 129.79 129.83 129.81 129.75 GBP/JPY 152.09 152.14 152.12 152.04 AUD/CAD 0.9332 0.9335 0.9334 0.9330 EUR/CHF 1.0839 1.0848 1.0844 1.0837 GBP/CHF 1.2696 1.2701 1.2699 1.2695 USD/CHF 0.9176 0.9179 0.9178 0.9174 USD/CAD 1.2689 1.2693 1.2691 1.2687 NZD/USD 0.7113 0.7114 0.7114 0.7110 Table 1: Exchange rates on 1st August, 2021. Mid rate = (bid rate + ask rate)/2 Bank B Ask 0.7357 0.6229 1.607 0.5316 1.8816 80.84 1.1816 1.3844 109.95 0.8545 129.84 152.16 0.9338 1.0848 1.2702 0.9180 1.2694 0.7116 Mid 0.7356 0.6226 1.6067 0.5313 1.8812 80.81 1.1814 1.3841 109.93 0.8541 129.80 152.10 0.9334 1.0843 1.2699 0.9177 1.2691 0.7113 Bid 0.7356 0.6224 1.6060 0.5312 1.8805 80.79 1.1812 1.3838 109.90 0.8537 129.77 152.05 0.9329 1.0836 1.2693 0.9175 1.2687 0.7111 Bank C Ask 0.7359 0.6228 1.6068 0.5319 1.8815 80.86 1.1819 1.3846 109.95 0.8545 129.87 152.15 0.9337 1.0847 1.2700 0.9181 1.2694 0.7115 Mid 0.7358 0.6226 1.6064 0.5316 1.8810 80.83 1.1816 1.3842 109.93 0.8541 129.82 152.10 0.9333 1.0842 1.2697 0.9178 1.2691 0.7113 Suggested Strategy Opinion Comm/ Terms Bid Ask (over/under/ fairly valued) AUD/CAD 0.9345 0.9349 GBP/USD 1.3858 1.3865 NZD/USD 0.7014 0.7103 Table 4: Actual forward FX rates for the end of September 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts