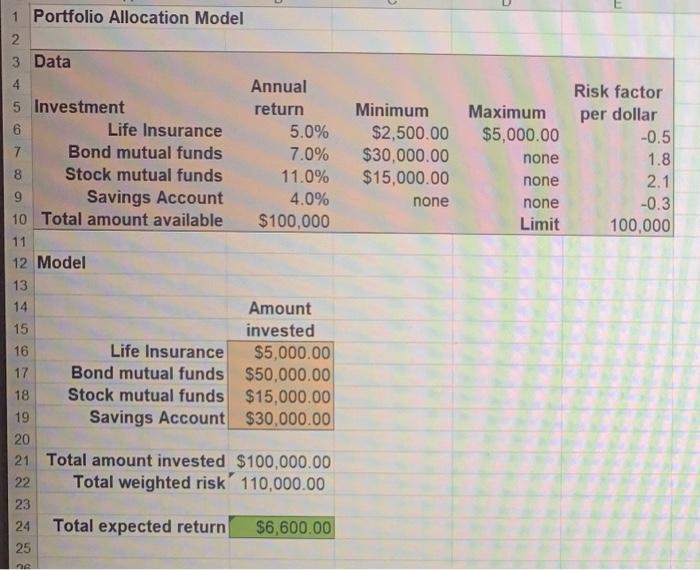

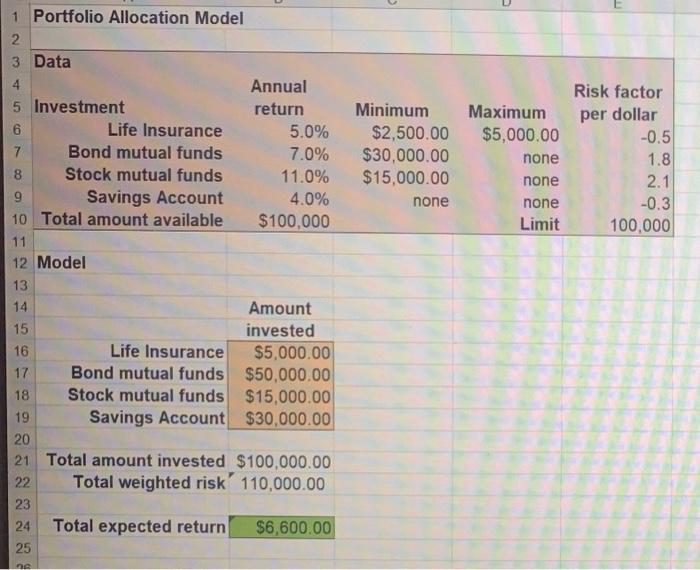

Question: Risk factor per dollar Minimum $2,500.00 $30,000.00 $15,000.00 none Maximum $5,000.00 none none none Limit -0.5 1.8 2.1 -0.3 100,000 1 Portfolio Allocation Model 2

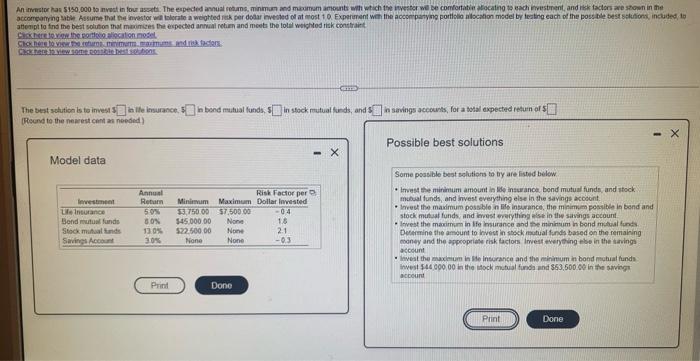

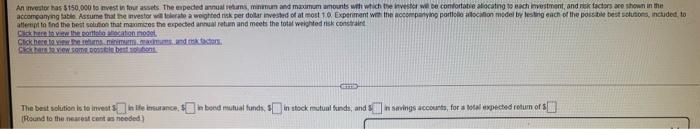

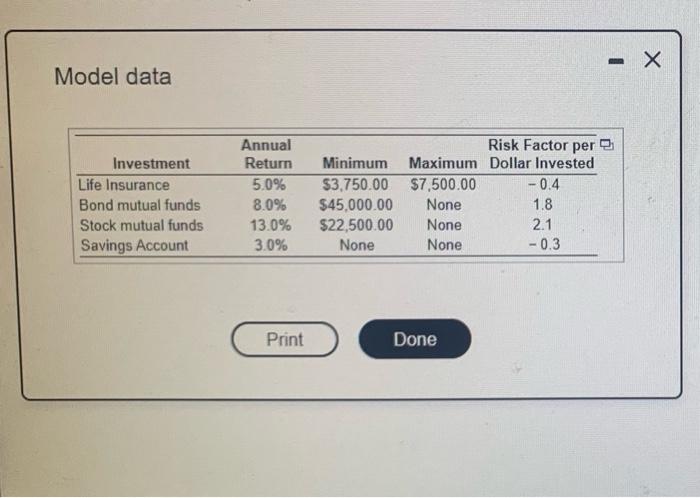

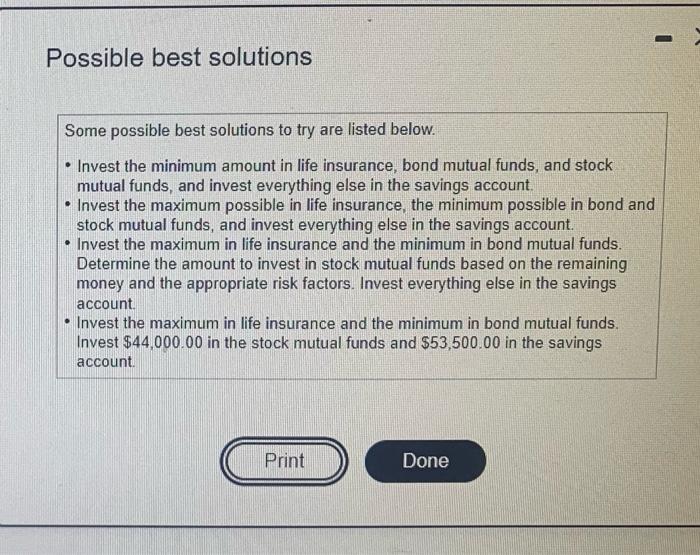

Risk factor per dollar Minimum $2,500.00 $30,000.00 $15,000.00 none Maximum $5,000.00 none none none Limit -0.5 1.8 2.1 -0.3 100,000 1 Portfolio Allocation Model 2 3 Data 4 Annual 5 Investment return 6 Life Insurance 5.0% 7 Bond mutual funds 7.0% 8 Stock mutual funds 11.0% 9 Savings Account 4.0% 10 Total amount available $100,000 11 12 Model 13 14 Amount 15 invested 16 Life Insurance $5,000.00 17 Bond mutual funds $50,000.00 18 Stock mutual funds $15,000.00 19 Savings Account $30,000.00 20 21 Total amount invested $100,000.00 22 Total weighted risk' 110,000.00 23 24 Total expected return $6,600.00 25 ne Antes has 5150,000 to not in fou The expeded annual rotams, minman and manam amount wh which the investorwe be comfortati cating to each investment and risk factors are stown in me accompanying at assume that the investor weate a weighted rik per dollar invested of a most 10. Experiment with the accompanying portionlocation model by testing each of the possibile e solutions, included to attempt to find the best solution that maximes the expected anrhum and meets the total weighted riscontrat Cherowhere allocation model Click here to minimum.dk facers ca The best solution is to invest in the murance, $nbond mutual funds, sin stock mutual funds, and $n savings accounts, for a total axpected return of $[ Roond to the nearestent as needed) Possible best solutions Model data Investment Ue Insurance Bond mutual funds Stock malands Savings Account Annual Return 50% BON 130% 30% Risk Factor per Minimum Maximum Dollar Invested $3,750.00 $7,500.00 -04 545000.00 None 18 $22.500 00 None 2.1 None None -03 Some possible best solutions to try are listed below Invest the minimum amount in insurance bond mutual funds and stock mutual funds, and invest everything else in the sayings acodont Invest the maidimum possible in life insurance, the minimum possible in bond and stock mutual funds, and invest verything else in the savings account Invest the marimum in life insurance and se minimum in bond mutual funds Determine the amount to invest in stock mutual funds based on the remaining money and the appropriate risk tactos Invest everything be in the savings account Invest the maximum in de intrance and the minimum in bond mutual funds invest 544 000,00 in the stock mutual funds and 553.600 00 in the saving account Print Done Print Done An investor has $150,000 to nvest in fousses Thempeded annual returns, minimum and maximum amounts with which the investor wiele confortable allocating to each investment and is actors are shown in the accompanying Gate Assume that the investorite a weighted risk per dollar invested of almost 10 Experiment with the accompanying portio location model by testing each of the possible best solutions, included, to attempt to find the best solution that maximizes the expected and return and meets the total weighted is constraint Cische low the correction Click here to read actor. Creat. SODOC berton Gm The best solution is to invest in the insuranc. $abood mutuat bunch, in stock mutual funds, and savings accounts, for expected return or Round to the nearest contas needed - X Model data Investment Life Insurance Bond mutual funds Stock mutual funds Savings Account Annual Return 5.0% 8.0% 13.0% 3.0% Risk Factor per Minimum Maximum Dollar Invested $3.750.00 $7,500.00 -0.4 $45,000.00 None 1.8 $22,500.00 None 2.1 None None -0.3 Print Done Possible best solutions Some possible best solutions to try are listed below. . . Invest the minimum amount in life insurance, bond mutual funds, and stock mutual funds, and invest everything else in the savings account. Invest the maximum possible in life insurance, the minimum possible in bond and stock mutual funds, and invest everything else in the savings account. Invest the maximum life insurance and the minimum in bond mutual funds. Determine the amount to invest in stock mutual funds based on the remaining money and the appropriate risk factors. Invest everything else in the savings account Invest the maximum in life insurance and the minimum in bond mutual funds. Invest $44,000.00 in the stock mutual funds and $53,500.00 in the savings account. . Print Done Minimum $2,500.00 $30,000.00 $15,000.00 none Maximum $5,000.00 none none none Limit Risk factor per dollar -0.5 1.8 2.1 -0.3 100,000 1 Portfolio Allocation Model 2 3 Data 4 Annual 5 Investment return 6 Life Insurance 5.0% 7 Bond mutual funds 7.0% 8 Stock mutual funds 11.0% 9 Savings Account 4.0% 10 Total amount available $100,000 11 12 Model 13 14 Amount 15 invested 16 Life Insurance $5,000.00 17 Bond mutual funds $50,000.00 18 Stock mutual funds $15,000.00 19 Savings Account $30,000.00 20 21 Total amount invested $100,000.00 22 Total weighted risk' 110,000.00 23 24 Total expected return $6,600.00 25 ne Risk factor per dollar Minimum $2,500.00 $30,000.00 $15,000.00 none Maximum $5,000.00 none none none Limit -0.5 1.8 2.1 -0.3 100,000 1 Portfolio Allocation Model 2 3 Data 4 Annual 5 Investment return 6 Life Insurance 5.0% 7 Bond mutual funds 7.0% 8 Stock mutual funds 11.0% 9 Savings Account 4.0% 10 Total amount available $100,000 11 12 Model 13 14 Amount 15 invested 16 Life Insurance $5,000.00 17 Bond mutual funds $50,000.00 18 Stock mutual funds $15,000.00 19 Savings Account $30,000.00 20 21 Total amount invested $100,000.00 22 Total weighted risk' 110,000.00 23 24 Total expected return $6,600.00 25 ne Antes has 5150,000 to not in fou The expeded annual rotams, minman and manam amount wh which the investorwe be comfortati cating to each investment and risk factors are stown in me accompanying at assume that the investor weate a weighted rik per dollar invested of a most 10. Experiment with the accompanying portionlocation model by testing each of the possibile e solutions, included to attempt to find the best solution that maximes the expected anrhum and meets the total weighted riscontrat Cherowhere allocation model Click here to minimum.dk facers ca The best solution is to invest in the murance, $nbond mutual funds, sin stock mutual funds, and $n savings accounts, for a total axpected return of $[ Roond to the nearestent as needed) Possible best solutions Model data Investment Ue Insurance Bond mutual funds Stock malands Savings Account Annual Return 50% BON 130% 30% Risk Factor per Minimum Maximum Dollar Invested $3,750.00 $7,500.00 -04 545000.00 None 18 $22.500 00 None 2.1 None None -03 Some possible best solutions to try are listed below Invest the minimum amount in insurance bond mutual funds and stock mutual funds, and invest everything else in the sayings acodont Invest the maidimum possible in life insurance, the minimum possible in bond and stock mutual funds, and invest verything else in the savings account Invest the marimum in life insurance and se minimum in bond mutual funds Determine the amount to invest in stock mutual funds based on the remaining money and the appropriate risk tactos Invest everything be in the savings account Invest the maximum in de intrance and the minimum in bond mutual funds invest 544 000,00 in the stock mutual funds and 553.600 00 in the saving account Print Done Print Done An investor has $150,000 to nvest in fousses Thempeded annual returns, minimum and maximum amounts with which the investor wiele confortable allocating to each investment and is actors are shown in the accompanying Gate Assume that the investorite a weighted risk per dollar invested of almost 10 Experiment with the accompanying portio location model by testing each of the possible best solutions, included, to attempt to find the best solution that maximizes the expected and return and meets the total weighted is constraint Cische low the correction Click here to read actor. Creat. SODOC berton Gm The best solution is to invest in the insuranc. $abood mutuat bunch, in stock mutual funds, and savings accounts, for expected return or Round to the nearest contas needed - X Model data Investment Life Insurance Bond mutual funds Stock mutual funds Savings Account Annual Return 5.0% 8.0% 13.0% 3.0% Risk Factor per Minimum Maximum Dollar Invested $3.750.00 $7,500.00 -0.4 $45,000.00 None 1.8 $22,500.00 None 2.1 None None -0.3 Print Done Possible best solutions Some possible best solutions to try are listed below. . . Invest the minimum amount in life insurance, bond mutual funds, and stock mutual funds, and invest everything else in the savings account. Invest the maximum possible in life insurance, the minimum possible in bond and stock mutual funds, and invest everything else in the savings account. Invest the maximum life insurance and the minimum in bond mutual funds. Determine the amount to invest in stock mutual funds based on the remaining money and the appropriate risk factors. Invest everything else in the savings account Invest the maximum in life insurance and the minimum in bond mutual funds. Invest $44,000.00 in the stock mutual funds and $53,500.00 in the savings account. . Print Done Minimum $2,500.00 $30,000.00 $15,000.00 none Maximum $5,000.00 none none none Limit Risk factor per dollar -0.5 1.8 2.1 -0.3 100,000 1 Portfolio Allocation Model 2 3 Data 4 Annual 5 Investment return 6 Life Insurance 5.0% 7 Bond mutual funds 7.0% 8 Stock mutual funds 11.0% 9 Savings Account 4.0% 10 Total amount available $100,000 11 12 Model 13 14 Amount 15 invested 16 Life Insurance $5,000.00 17 Bond mutual funds $50,000.00 18 Stock mutual funds $15,000.00 19 Savings Account $30,000.00 20 21 Total amount invested $100,000.00 22 Total weighted risk' 110,000.00 23 24 Total expected return $6,600.00 25 ne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts