Question: risk free rate =8% Consider the following data for a particular sample period when returns were high. Portfolio P - Average return 35%, beta 1.2

risk free rate =8%

risk free rate =8%

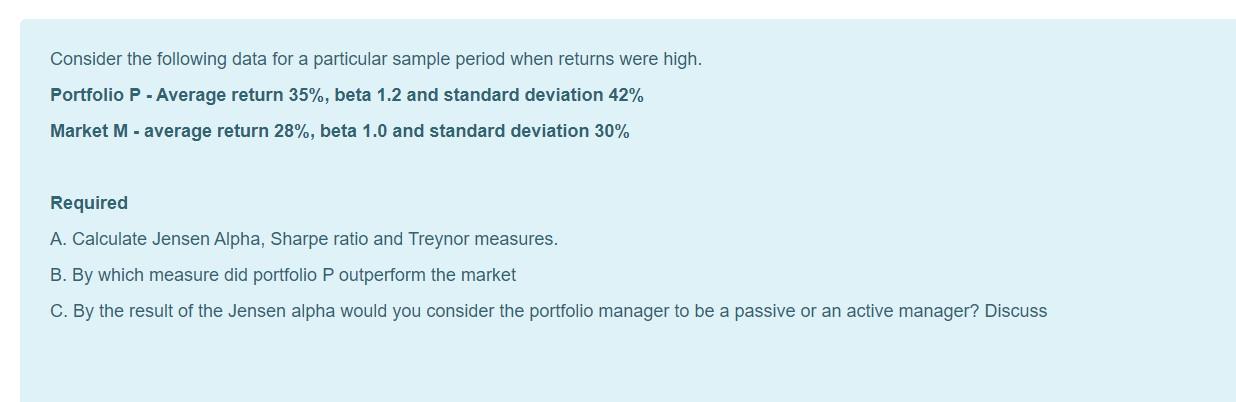

Consider the following data for a particular sample period when returns were high. Portfolio P - Average return 35%, beta 1.2 and standard deviation 42% Market M - average return 28%, beta 1.0 and standard deviation 30% Required A. Calculate Jensen Alpha, Sharpe ratio and Treynor measures. B. By which measure did portfolio P outperform the market C. By the result of the Jensen alpha would you consider the portfolio manager to be a passive or an active manager? Discuss

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock