Question: Risk Management and Statistics Question 1. Rework the diversification problem we saw in class for n=4. Recall the individual loss distribution for each person in

Risk Management and Statistics

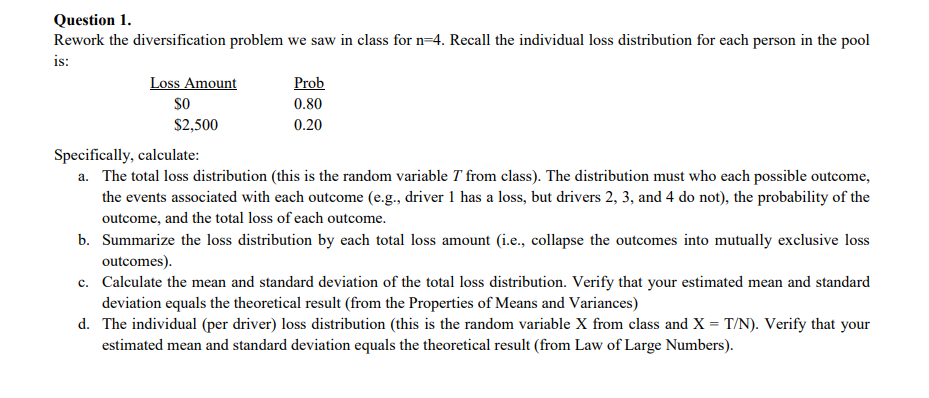

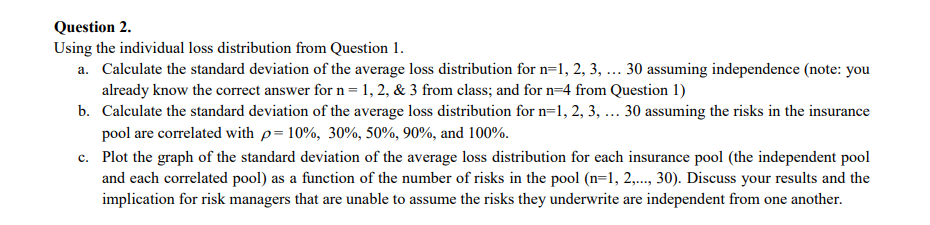

Question 1. Rework the diversification problem we saw in class for n=4. Recall the individual loss distribution for each person in the pool is: Loss Amount Prob 0.80 $2,500 0.20 Specifically, calculate: a. The total loss distribution (this is the random variable 7 from class). The distribution must who each possible outcome, the events associated with each outcome (e.g., driver 1 has a loss, but drivers 2, 3, and 4 do not), the probability of the outcome, and the total loss of each outcome. b. Summarize the loss distribution by each total loss amount (i.e., collapse the outcomes into mutually exclusive loss outcomes). c. Calculate the mean and standard deviation of the total loss distribution. Verify that your estimated mean and standard deviation equals the theoretical result (from the Properties of Means and Variances) d. The individual (per driver) loss distribution (this is the random variable X from class and X = T/N). Verify that your estimated mean and standard deviation equals the theoretical result (from Law of Large Numbers).Question 2. Using the individual loss distribution from Question 1. a. Calculate the standard deviation of the average loss distribution for n=1, 2, 3, 30 assuming independence (note: you already know the correct answer for n = l, 2, 8: 3 from class; and for n=4 from Question 1) b. Calculate the standard deviation of the average loss distribution for n=1, 2, 3, 30 assuming the risks in the insurance pool are correlated with p= 10%, 30%, 50%, 90%, and 100%. c. Plot the graph of the standard deviation of the average loss distribution for each insurance pool (the independent pool and each correlated pool] as a function of the number of risks in the pool (n=1, 2,..., 30). Discuss your results and the implication for risk managers that are unable to assume the risks they underwrite are independent from one another

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts