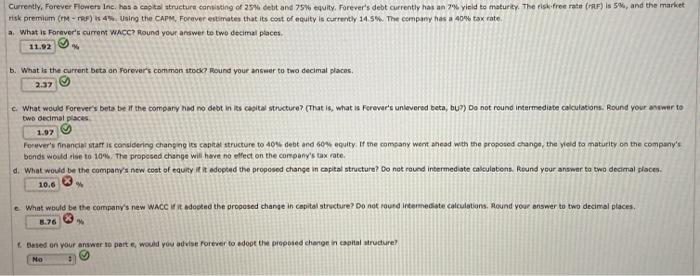

Question: risk premium ( m - Maf) is 45 . Using the CaPM. Forever enimater that its cost of equity is currently 14.5W. The company has

risk premium ( m - Maf) is 45 . Using the CaPM. Forever enimater that its cost of equity is currently 14.5W. The company has a 40% tax rate. a. What is Forever's current whcc? Round your answer to two decimal pices. ins b. What is the current beta an forever's comman stodo nound your answer to two decimal placos. c. What would forever's beta be if the compary had no debt in its casital sthecture? (That is, what is Forevar's unlevered teta, bu?) Do not round intermediate cakculations. Round your asivar to two oecimal piaces Forever's fnanciat starf is consicering changing its cophat structure to 403 debt and 60\% ecuity if the company went ancad with the proposed crange, the veld fo maturity on the company's bends would eise to 10%. The propesed change will heve no eliect on the company's tax rate. d. What would be the company's new cost of equiy it it edogted the proposed change in copital structure? Do not raund intermediste caltulatens. Reund your answer to two decimal places. (3) % What would be the company's new Wacc if it adooted the proposed change in copital strocture? Do not rourd intermediate caiculations. Mound your answer to two decimal places. 8. Bates on your answer to pait , would you advise fortever to edopt the prepesed cherge in eaphal atructure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts