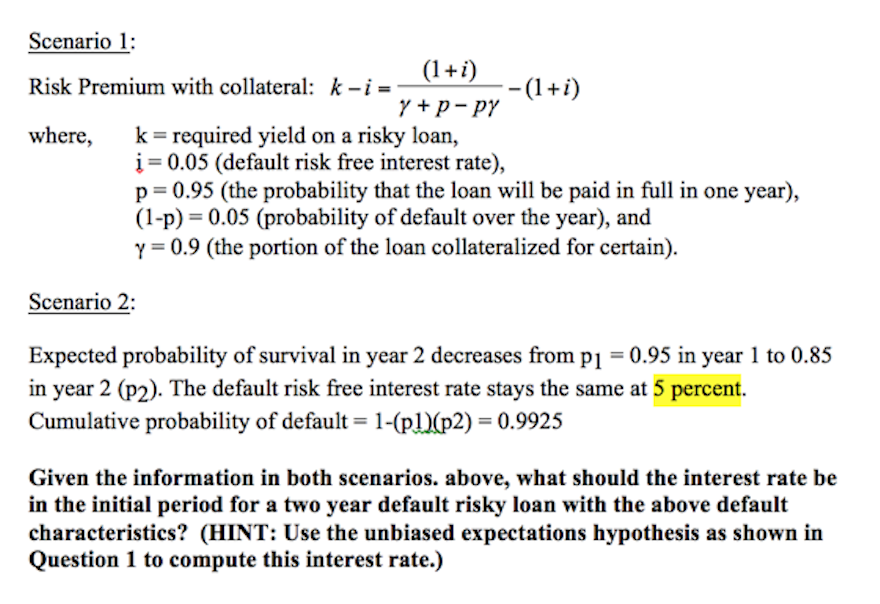

Question: Risk Premium with collateral: k - i = (1 + i)/gamma + p - p gamma - (1 + i) where, k = required yield

Risk Premium with collateral: k - i = (1 + i)/gamma + p - p gamma - (1 + i) where, k = required yield on a risky loan, i = 0.05 (default risk free interest rate), p = 0.95 (the probability that the loan will be paid in full in one year), (1-p) = 0.05 (probability of default over the year), and gamma = 0.9 (the portion of the loan collateralized for certain). Scenario 2: Expected probability of survival in year 2 decreases from p_1 = 0.95 in year 1 to 0.85 in year 2 (p_2). The default risk free interest rate stays the same at 5 percent. Cumulative probability of default = 1-(p1)(p2) = 0.9925 Given the information in both scenarios, above, what should the interest rate be in the initial period for a two year default risky loan with the above default characteristics

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts