Question: Risk, Return, and the Capital Asset Pricing Model Instructions: Work in your groups to fill in the areas with INVESTMENT RETURNS Amount invested Amount

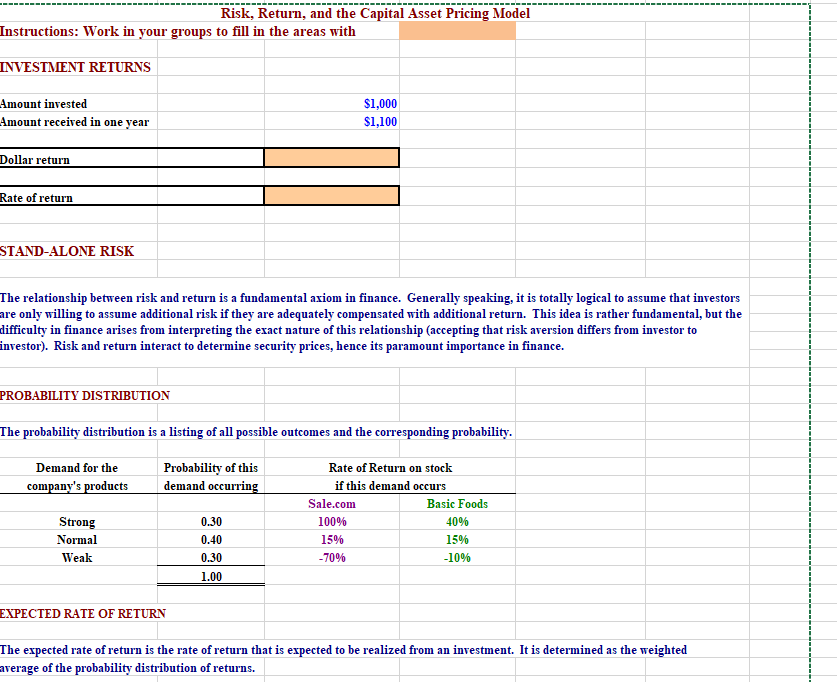

Risk, Return, and the Capital Asset Pricing Model Instructions: Work in your groups to fill in the areas with INVESTMENT RETURNS Amount invested Amount received in one year Dollar return Rate of return STAND-ALONE RISK $1,000 $1,100 The relationship between risk and return is a fundamental axiom in finance. Generally speaking, it is totally logical to assume that investors are only willing to assume additional risk if they are adequately compensated with additional return. This idea is rather fundamental, but the difficulty in finance arises from interpreting the exact nature of this relationship (accepting that risk aversion differs from investor to investor). Risk and return interact to determine security prices, hence its paramount importance in finance. PROBABILITY DISTRIBUTION The probability distribution is a listing of all possible outcomes and the corresponding probability. Demand for the company's products Probability of this demand occurring Rate of Return on stock if this demand occurs Sale.com Basic Foods Strong Normal 0.30 100% 40% 0.40 15% 15% Weak 0.30 -70% -10% 1.00 EXPECTED RATE OF RETURN The expected rate of return is the rate of return that is expected to be realized from an investment. It is determined as the weighted average of the probability distribution of returns.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts