Question: Risk versus return is a core concept in personal finance. As an investor in the financial markets, you will need to be willing to hold

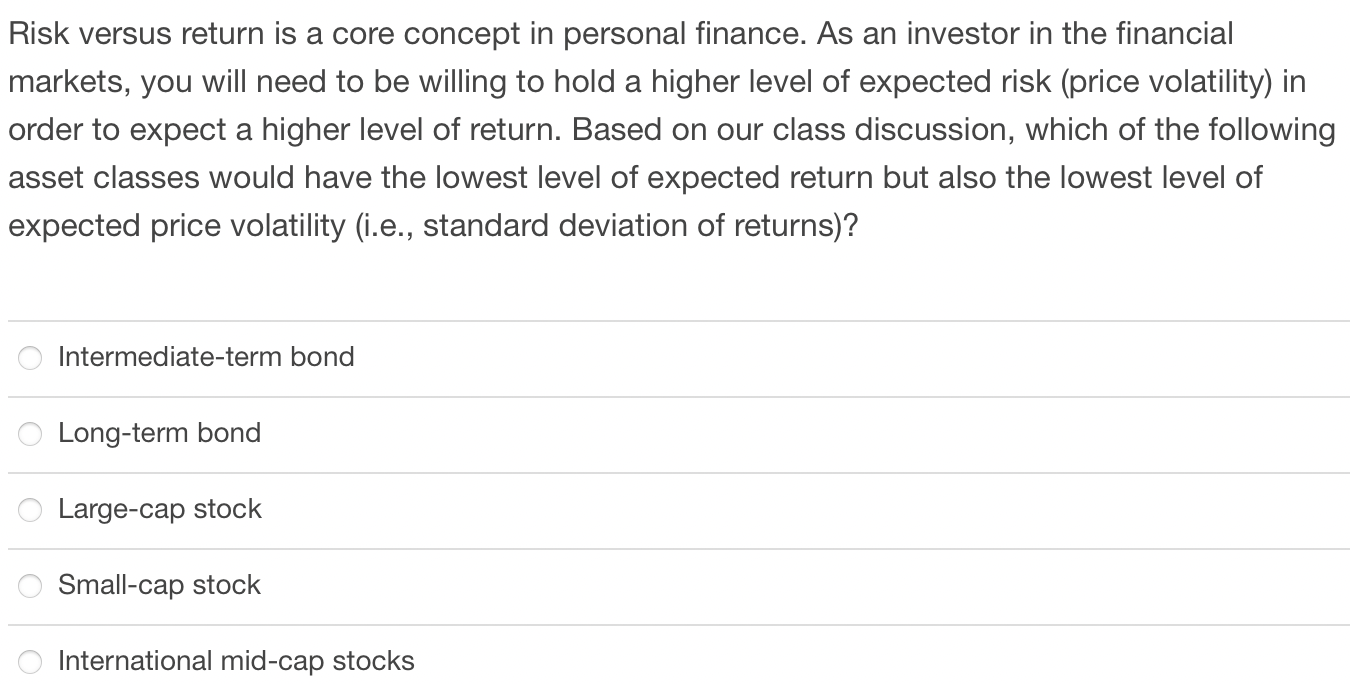

Risk versus return is a core concept in personal finance. As an investor in the financial markets, you will need to be willing to hold a higher level of expected risk (price volatility) in order to expect a higher level of return. Based on our class discussion, which of the following asset classes would have the lowest level of expected return but also the lowest level of expected price volatility (i.e., standard deviation of returns)? Intermediate-term bond Long-term bond Large-cap stock Small-cap stock International mid-cap stocks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock