Question: Ri,t Rb,t = a; + Bi(CAB Rb,t) + it For each endowment i, Ri,t Rb,t is the excess return relative to the riskless interest rate

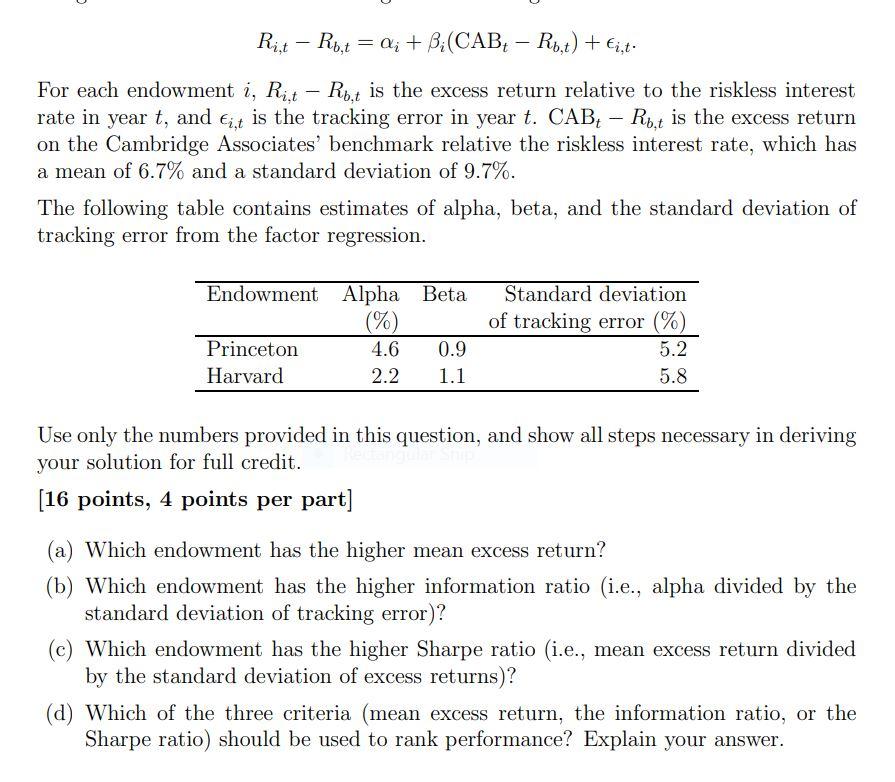

Ri,t Rb,t = a; + Bi(CAB Rb,t) + it For each endowment i, Ri,t Rb,t is the excess return relative to the riskless interest rate in year t, and ,t is the tracking error in year t. CAB+ Rb,t is the excess return on the Cambridge Associates' benchmark relative the riskless interest rate, which has a mean of 6.7% and a standard deviation of 9.7%. The following table contains estimates of alpha, beta, and the standard deviation of tracking error from the factor regression. Endowment Alpha Beta Standard deviation of tracking error (%) 5.2 5.8 Princeton Harvard 4.6 2.2 0.9 1.1 Use only the numbers provided in this question, and show all steps necessary in deriving your solution for full credit. (16 points, 4 points per part] (a) Which endowment has the higher mean excess return? (b) Which endowment has the higher information ratio (i.e., alpha divided by the standard deviation of tracking error)? (c) Which endowment has the higher Sharpe ratio (i.e., mean excess return divided by the standard deviation of excess returns)? (d) Which of the three criteria (mean excess return, the information ratio, or the Sharpe ratio) should be used to rank performance? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts