Question: Riverbed Co. recently installed some new computer equipment. To prepare for the installation, Riverbed had some electrical work done in what was to become

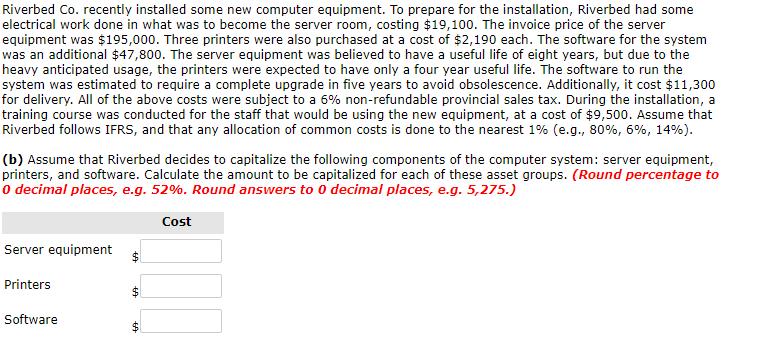

Riverbed Co. recently installed some new computer equipment. To prepare for the installation, Riverbed had some electrical work done in what was to become the server room, costing $19,100. The invoice price of the server equipment was $195,000. Three printers were also purchased at a cost of $2,190 each. The software for the system was an additional $47,800. The server equipment was believed to have a useful life of eight years, but due to the heavy anticipated usage, the printers were expected to have only a four year useful life. The software to run the system was estimated to require a complete upgrade in five years to avoid obsolescence. Additionally, it cost $11,300 for delivery. All of the above costs were subject to a 6% non-refundable provincial sales tax. During the installation, a training course was conducted for the staff that would be using the new equipment, at a cost of $9,500. Assume that Riverbed follows IFRS, and that any allocation of common costs is done to the nearest 1% (e.g., 80%, 6%, 14%). (b) Assume that Riverbed decides to capitalize the following components of the computer system: server equipment, printers, and software. Calculate the amount to be capitalized for each of these asset groups. (Round percentage to O decimal places, e.g. 52%. Round answers to 0 decimal places, e.g. 5,275.) Cost Server equipment Printers $4 Software

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Server 230628 Printers 7770 Software 56534 Server Pr... View full answer

Get step-by-step solutions from verified subject matter experts