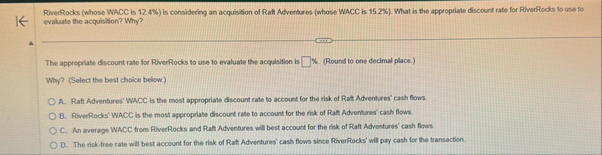

Question: RiverRocks ( whose WACC is 1 2 . 4 % ) is considering an acquistion of Raft Adventures ( whose WACC is 1 5 .

RiverRocks whose WACC is is considering an acquistion of Raft Adventures whose WACC is What is the appropriate discount rate for RiverPlocks to use to evaluate the acquisition? Why?

The appropriate discount rate for RiverRocks to use to evaluate the acquisition is Round to one decimal place.

Why? Select the best choice below

A Rath Adventures' WACC is the most appropriate discount rate to account for the risk of Ratt Adventures' cash flows.

B RiverRock' WACC is the most appropriate discount rate to account for the risk of Rate Adventures' cash flows.

C An average WACC from RiverRocks and Ratt Adventures will best account for the fisk of Raft Adventures' cash flows

D The riskfree rate will best account for the risk of Rath Adventures' cash flows since RiverRocks' will pay cash for the transaction.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock