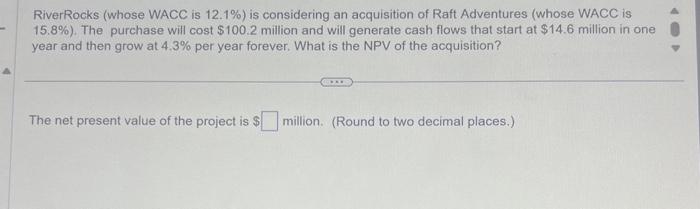

Question: RiverRocks (whose WACC is 12.1% ) is considering an acquisition of Raft Adventures (whose WACC is 15.8% ). The purchase will cost $100.2 million and

RiverRocks (whose WACC is 12.1% ) is considering an acquisition of Raft Adventures (whose WACC is 15.8% ). The purchase will cost $100.2 million and will generate cash flows that start at $14.6 million in one year and then grow at 4.3% per year forever. What is the NPV of the acquisition? The net present value of the project is $ million. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts