Question: rk Check My Work button is now enabled Item 1 Required informationRequired informationSkip to question [ The following information applies to the questions displayed below.

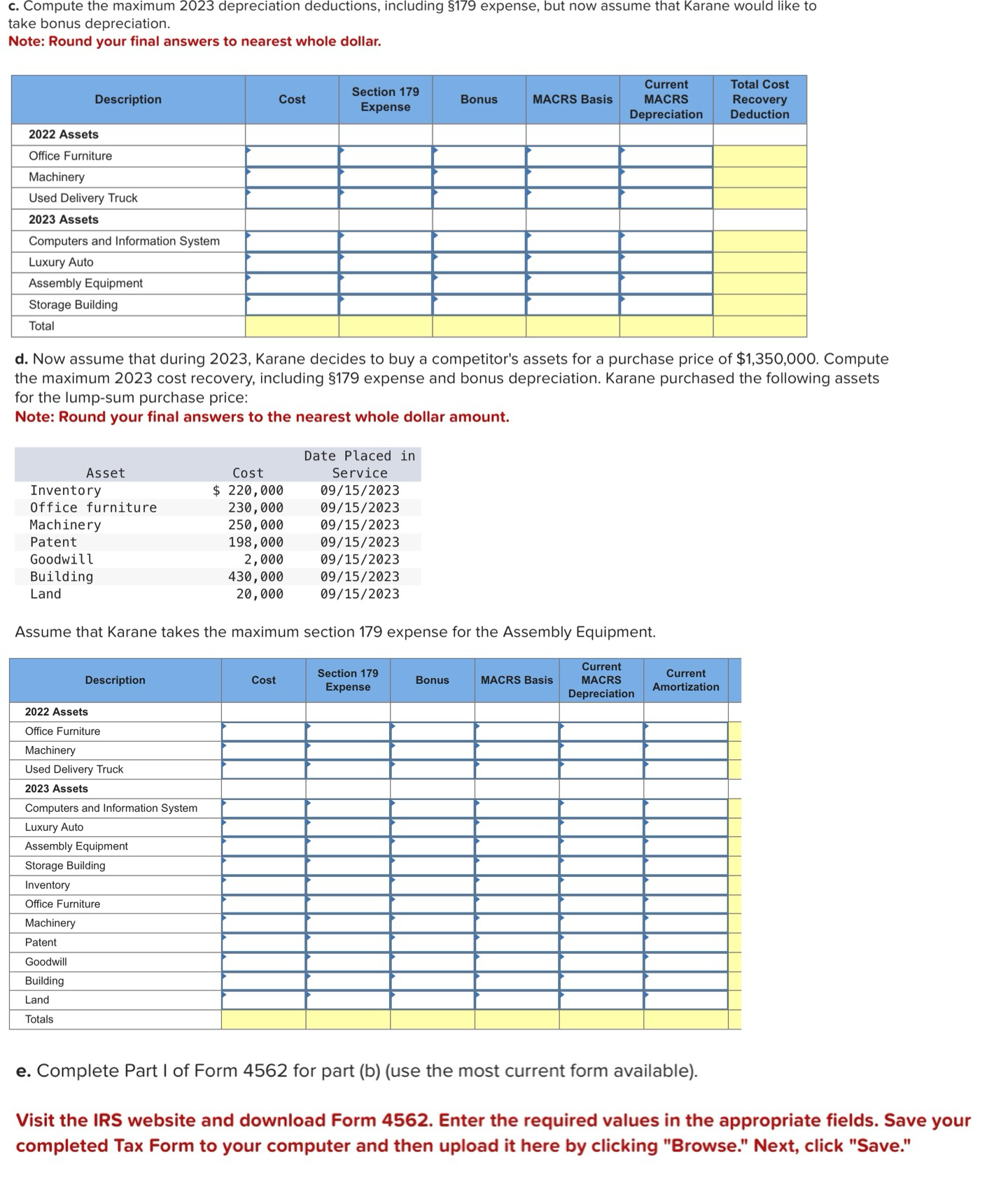

rk Check My Work button is now enabled Item Required informationRequired informationSkip to questionThe following information applies to the questions displayed below.Karane Enterprises, a calendaryear manufacturer based in College Station, Texas, began business in In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during :AssetCostDate Placed in ServiceOffice furniture$ MachineryUsed delivery truckNote:Note:Not considered a luxury automobile.During Karane was very successful and had no limitations and decided to acquire more assets in to increase its production capacity. These are the assets acquired during :AssetCostDate Placed in ServiceComputers and information system$ Luxury autoNote:Assembly equipmentStorage buildingNote:Used for business purposes.Karane generated taxable income in of $ for purposes of computing the expense limitationUse MACRS Table Table Table Table Table and Exhibit Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock