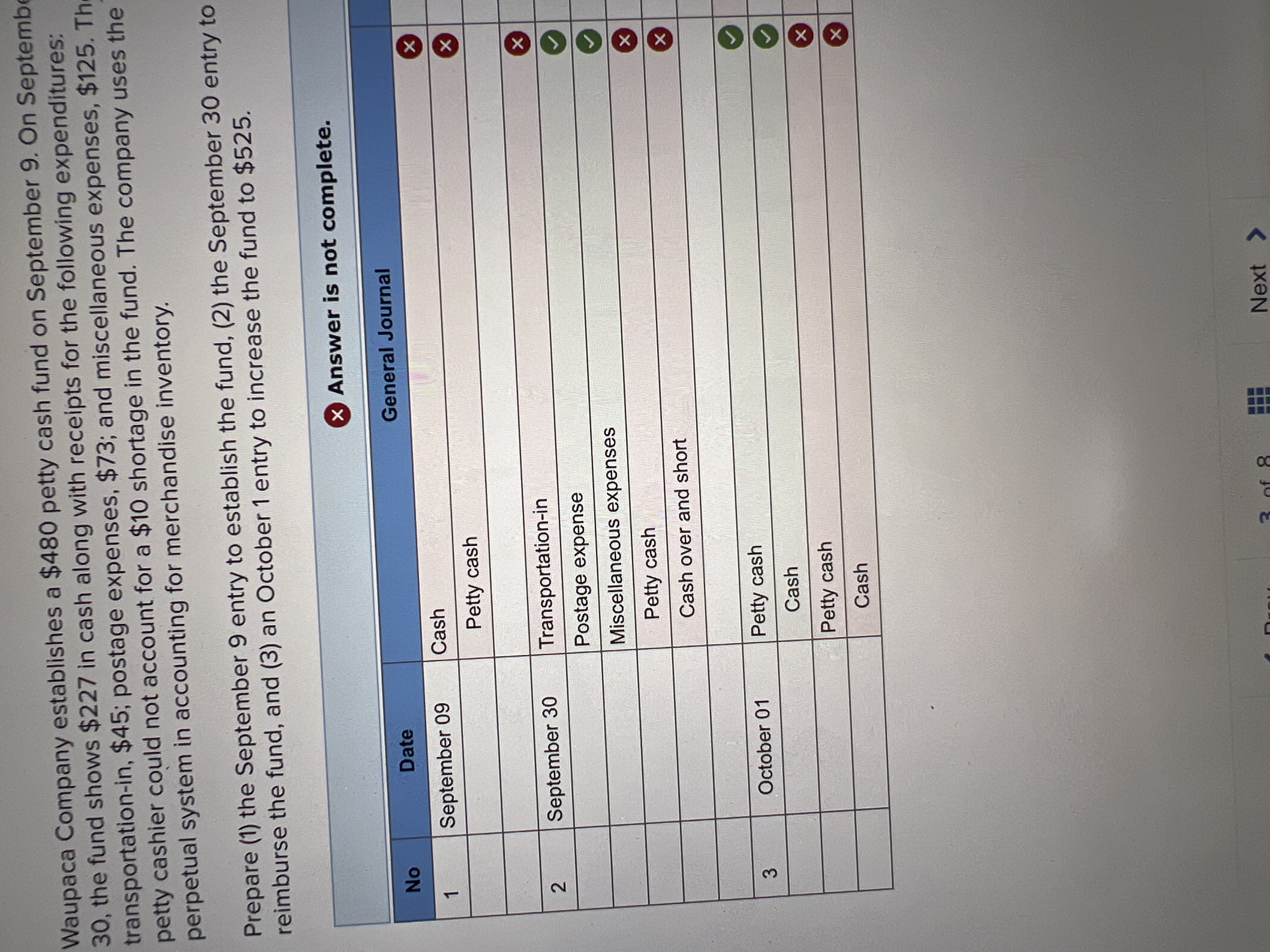

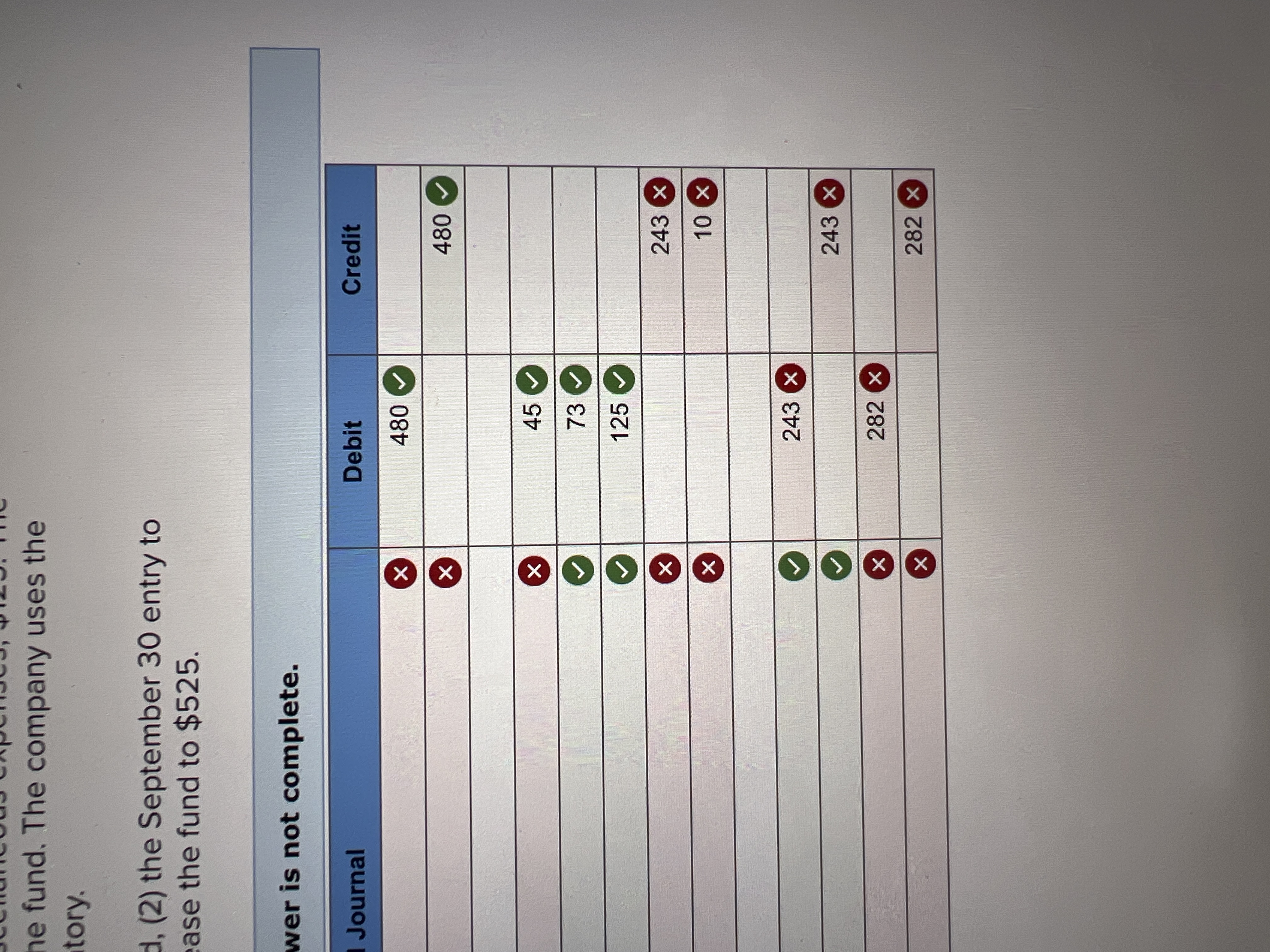

Question: rk i Saved Help Save & Exit Submit Check my work Waupaca Company establishes a $480 petty cash fund on September 9. On September 30,

rk i Saved Help Save & Exit Submit Check my work Waupaca Company establishes a $480 petty cash fund on September 9. On September 30, the fund shows $227 in cash along with receipts for the following expenditures: transportation-in, $45; postage expenses, $73; and miscellaneous expenses, $125. The petty cashier could not account for a $10 shortage in the fund. The company uses the perpetual system in accounting for merchandise inventory. Prepare (1) the September 9 entry to establish the fund, (2) the September 30 entry to reimburse the fund, and (3) an October 1 entry to increase the fund to $525. View transaction list Journal entry worksheet 2 3 Prepare the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date General Journal Debit Credit September 09 Record entry Clear entry View general journal30, the fund shows $227 in cash along with receipts for the following expenditures: transportation-in, $45; postage expenses, $73; and miscellaneous expenses, $125. The petty cashier could not account for a $10 shortage in the fund. The company uses the perpetual system in accounting for merchandise inventory. Prepare (1) the September 9 entry to establish the fund, (2) the September 30 entry to reimburse the fund, and (3) an October 1 entry to increase the fund to $525. View transaction list Journal entry worksheet 2 3 Prepare the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date General Journal Debit Credit September 09 Record entry Clear entry View general journal , the fund shows $22/ in cash along with ansportation-in, $45; postage expenses, $73; and miscellaneous expenses, $125. The etty cashier could not account for a $10 shortage in the fund. The company uses the erpetual system in accounting for merchandise inventory. epare (1) the September 9 entry to establish the fund, (2) the September 30 entry to imburse the fund, and (3) an October 1 entry to increase the fund to $525. View transaction list Journal entry worksheet 3 Record the reimbursement of the petty cash fund. Note: Enter debits before credits. Date General Journal Debit Credit September 30 View general journal Record entry Clear entry paca Company establishes a $480 petty cash fund on Septem he fund shows $227 in cash along with receipts for the following expenditures: sportation-in, $45; postage expenses, $73; and miscellaneous expenses, $125. The y cashier could not account for a $10 shortage in the fund. The company uses the petual system in accounting for merchandise inventory. pare (1) the September 9 entry to establish the fund, (2) the September 30 entry to mburse the fund, and (3) an October 1 entry to increase the fund to $525. View transaction list Journal entry worksheet 2 Record the increase of the petty cash fund. Note: Enter debits before credits. Date General Journal Debit Credit October 01 Record entry Clear entry View general journalWaupaca Company establishes a $480 petty cash fund on September 9. On Septemb 30, the fund shows $227 in cash along with receipts for the following expenditures: transportation-in, $45; postage expenses, $73; and miscellaneous expenses, $125. Th petty cashier could not account for a $10 shortage in the fund. The company uses the perpetual system in accounting for merchandise inventory. Prepare (1) the September 9 entry to establish the fund, (2) the September 30 entry to reimburse the fund, and (3) an October 1 entry to increase the fund to $525. x Answer is not complete. No Date General Journal 1 September 09 Cash X Petty cash X 2 September 30 Transportation-in X Postage expense Miscellaneous expenses Petty cash X Cash over and short X 3 October 01 Petty cash he fund. The company uses the tory. d, (2) the September 30 entry to ase the fund to $525. wer is not complete. Journal Debit Credit X 480 X 480 X 45 V V 73 V 125 X 243 X X 10 X 243 X V 243 X X 282 X X 282 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts