Question: rk mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. The following

rk mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion.

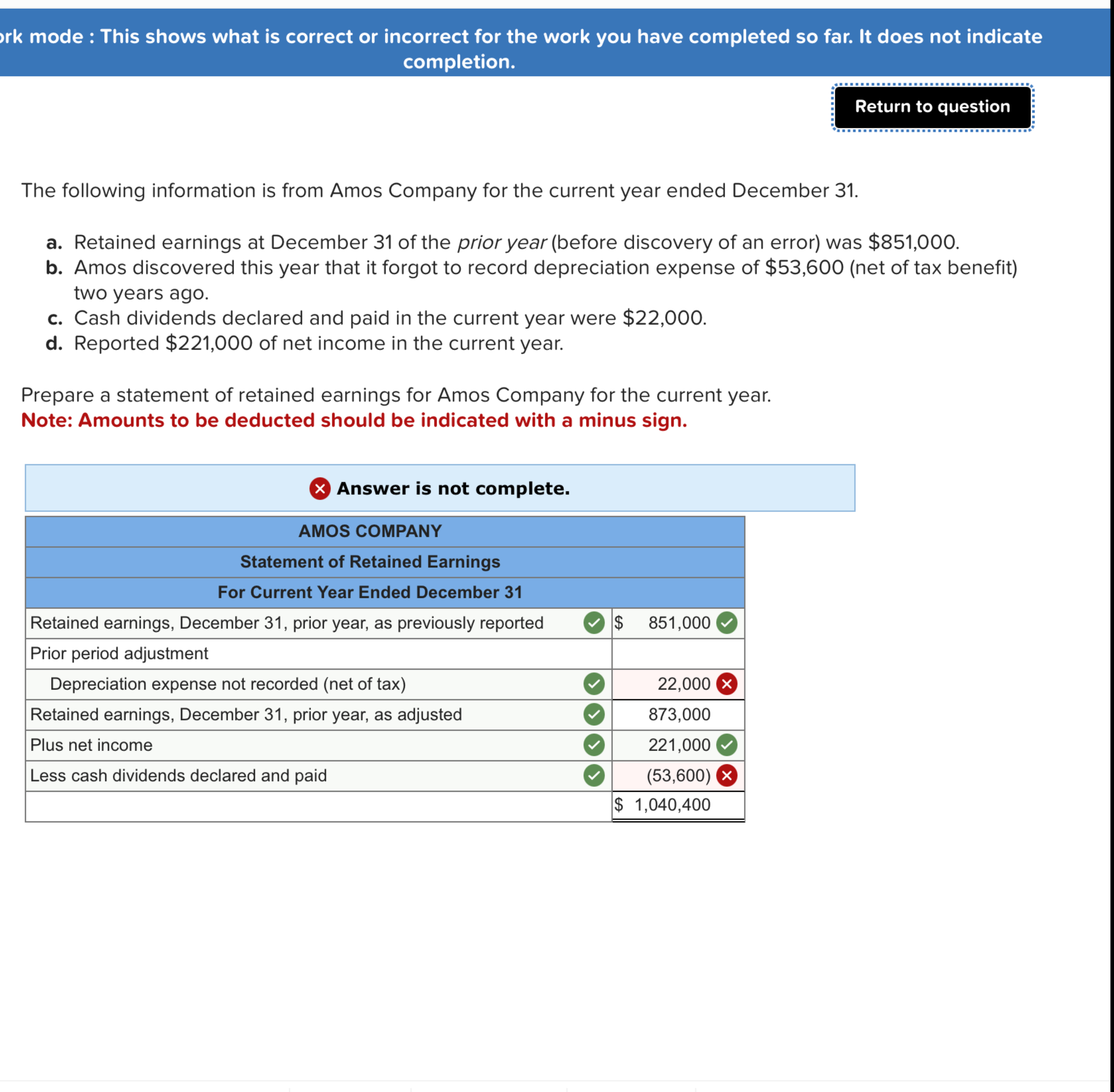

The following information is from Amos Company for the current year ended December

a Retained earnings at December of the prior year before discovery of an error was $

b Amos discovered this year that it forgot to record depreciation expense of $net of tax benefit two years ago.

c Cash dividends declared and paid in the current year were $

d Reported $ of net income in the current year.

Prepare a statement of retained earnings for Amos Company for the current year.

Note: Amounts to be deducted should be indicated with a minus sign.

Answer is not complete.

tableAMOS COMPANYStatement of Retained EarningsFor Current Year Ended December Retained earnings, December prior year, as previously reported,$ Prior period adjustmentDepreciation expense not recorded net of taxtimes Retained earnings, December prior year, as adjusted,Plus net income,Less cash dividends declared and paid,times $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock