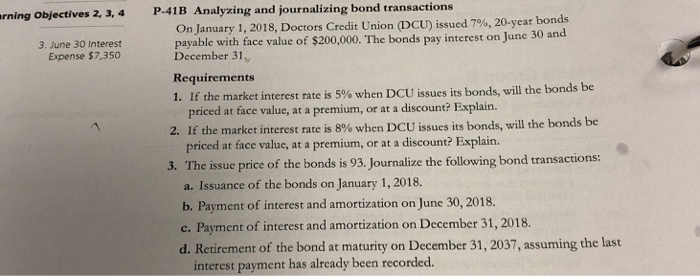

Question: rning Objectives 2, 3,4 P-41B Analyzing and journalizing bond transactions On January 1, 2018, Doctors Credit Union (DCU) issued 7%, 20-year bonds payable with face

rning Objectives 2, 3,4 P-41B Analyzing and journalizing bond transactions On January 1, 2018, Doctors Credit Union (DCU) issued 7%, 20-year bonds payable with face value of $200,000. The bonds pay interest on June 30 an December 31 pay 3pe 30 1730pochic er Expense $7,350 Requirements 1. If the market interest rate is 5% when DCU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. 2. If the market interest rate is 8% when DCU issues its bonds, will the bonds be priced at face value, at a premium, or at a discount? Explain. 3. The issue price of the bonds is 93. Journalize the following bond transactions: a. Issuance of the bonds on January 1, 2018. b. Payment of interest and amortization on June 30, 2018. c. Payment of interest and amortization on December 31, 2018. d. Retirement of the bond at maturity on December 31, 2037, assuming the last interest payment has already been recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts