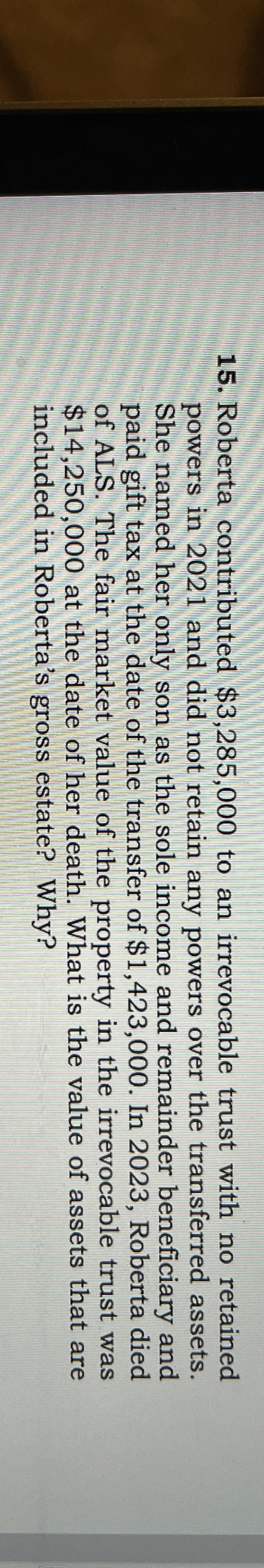

Question: Roberta contributed $ 3 , 2 8 5 , 0 0 0 to an irrevocable trust with no retained powers in 2 0 2 1

Roberta contributed $ to an irrevocable trust with no retained powers in and did not retain any powers over the transferred assets. She named her only son as the sole income and remainder beneficiary and paid gift tax at the date of the transfer of $ In Roberta died of ALS. The fair market value of the property in the irrevocable trust was $ at the date of her death. What is the value of assets that are included in Roberta's gross estate? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock