Question: Robin Company's A Division produces a small component used by other companies as a key part in their products. Cost and sales data relating to

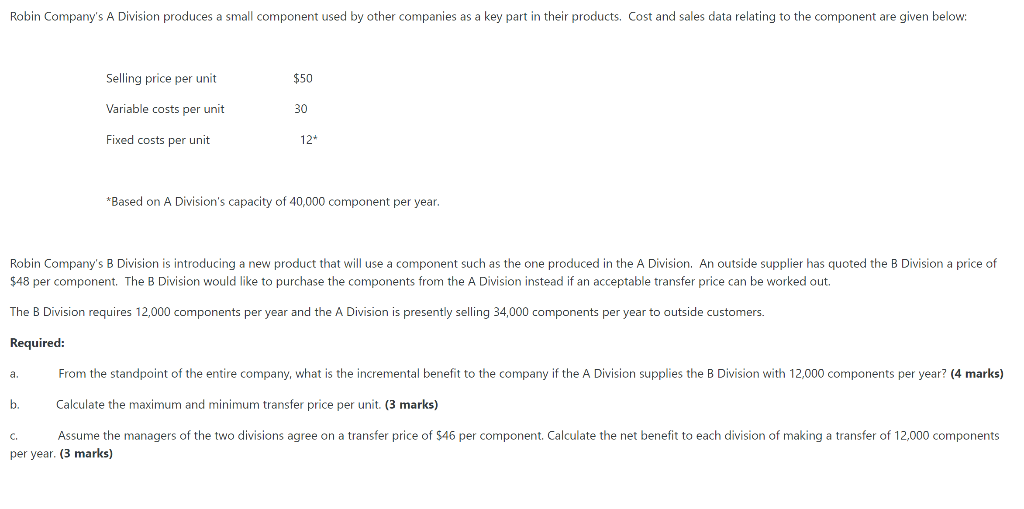

Robin Company's A Division produces a small component used by other companies as a key part in their products. Cost and sales data relating to the component are given below: Selling price per unit $50 Variable costs per unit 30 Fixed costs per unit 12* *Based on A Division's capacity of 40,000 component per year. Robin Company's B Division is introducing a new product that will use a component such as the one produced in the A Division. An outside supplier has quoted the B Division a price of $48 per component. The B Division would like to purchase the components from the A Division instead if an acceptable transfer price can be worked out. The B Division requires 12,000 components per year and the A Division is presently selling 34,000 components per year to outside customers. Required: a. From the standpoint of the entire company, what is the incremental benefit to the company if the A Division supplies the B Division with 12,000 components per year? (4 marks) b Calculate the maximum and minimum transfer price per unit. (3 marks) C Assume the managers of the two divisions agree on a transfer price of $46 per component. Calculate the net benefit to each division of making a transfer of 12,000 components per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts