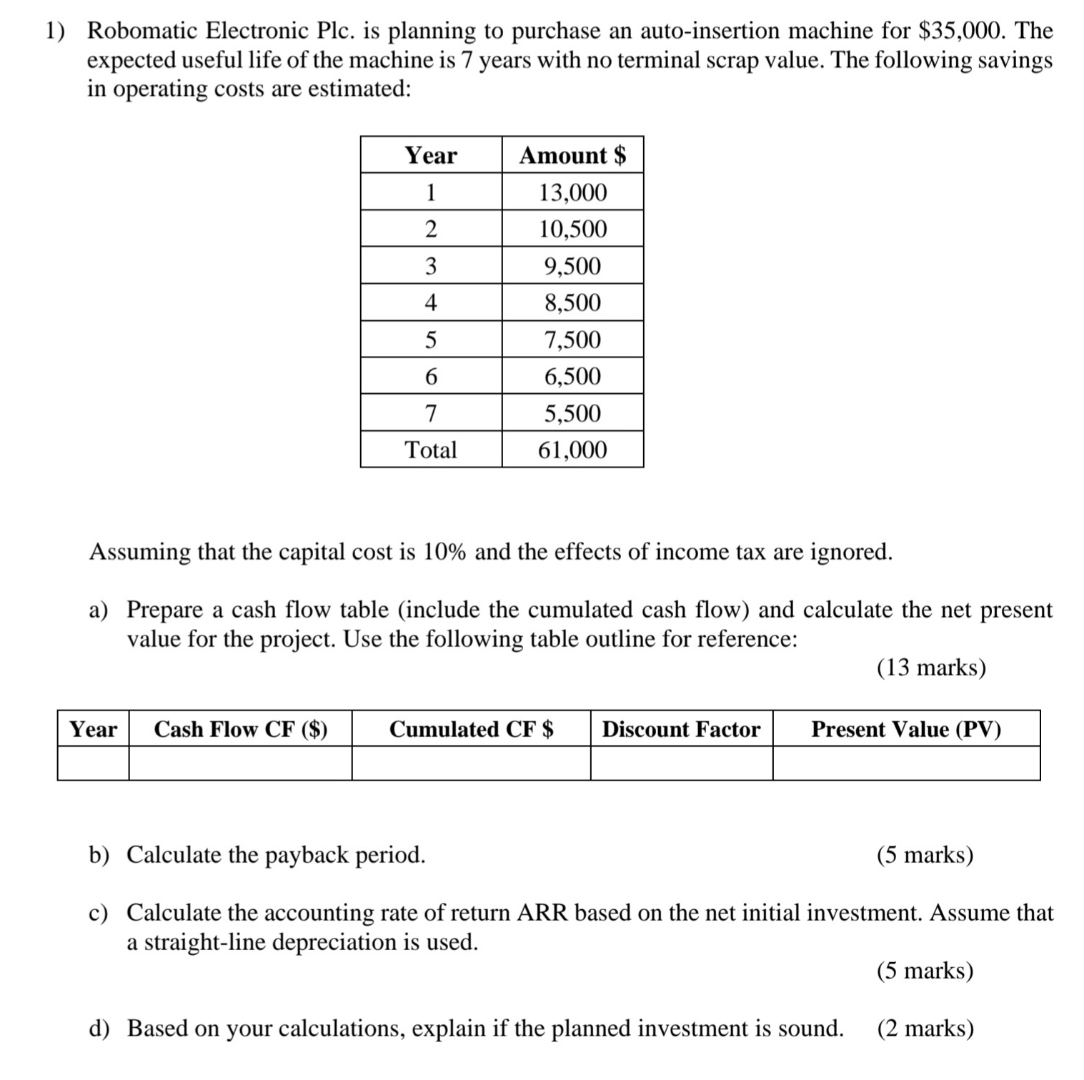

Question: Robomatic Electronic Plc . is planning to purchase an auto - insertion machine for $ 3 5 , 0 0 0 . The expected useful

Robomatic Electronic Plc is planning to purchase an autoinsertion machine for $ The expected useful life of the machine is years with no terminal scrap value. The following savings in operating costs are estimated:

tableYearAmount $Total

Assuming that the capital cost is and the effects of income tax are ignored.

a Prepare a cash flow table include the cumulated cash flow and calculate the net present value for the project. Use the following table outline for reference:

marks

tableYearCash Flow CF $Cumulated CF $Discount Factor,Present Value PV

b Calculate the payback period.

marks

c Calculate the accounting rate of return ARR based on the net initial investment. Assume that a straightline depreciation is used.

marks

d Based on your calculations, explain if the planned investment is sound.

marks

Saturn Design Studio SDS is considering to purchase a new computer system, branded Solar II It includes a professional graphic design software and a highquality printer which together are expected to expand its design business. The initial cost of Solar II is $ and has an estimated year life. Its estimated resale scrap value after years is $

It is estimated that the future cash inflows generated by the computer system will be $ each year for the next four years. Assuming that all payments and receipts take place at the beginning or the end of a year:

Page of

a Calculate the NPV of the project at a cost of capital of Use the following table outline for reference:

marks

tableYearNet Cash Flow NCF $Discount Factor,Present Value PV

b Suppose that the price of Solar II has been reduced to $ Calculate the updated NPV of the project cost of capital remains unchanged Use the following table outline for reference:

tableYearNet Cash Flow NCF $Discount Factor,Present Value PV

Based on the updated NPV value, should SDS purchase the computer system in this or the previous case?

marks

c Suppose that a new computer system branded Universe IR will be launched in the near future with a cost of $ The computer system can be used for five years and will generate cash inflows of $ per year for years. It is estimated that Universe IR can be sold for $ at the end of year

In this situation, calculate the NPV of the project the capital cost remains unchanged Use the following table outline for reference:

marks

tableYearNet Cash Flow NCF $Discount Factor,Present Value PV

d Considering the previously obtained results, which computer system should SDS purchase: the discounted Solar II for $ or the soontobereleased Universe IR for $ Please provide a rationale for your recommendation.

mark

Cosmo Plant Engineering Co Limited is planning to purchase a machine for $ which has an estimated life of years. It is estimated that the machine's operating and maintenance O&M costs amount to $ and a parttime operator will be employed at a cost of $ for the first year. From then onwards, O&M costs are expected to increase at annually due to inflation while the operator cost is expected to increase at a annually due salary increase agreed with the union.

Page of

Cosmo Plant Engineering expects to generate profits by producing and selling units of Product X in the first years, in the th & th year and in the th year. The selling price and raw material cost for each product are $ and $ respectively. The machine has a scrap value of $ at the end of the th year. Assuming that all payments and receipts take place at the beginning or the end of a year:

a Prepare a table for the net cash flow of the project. Use the following table outline for reference:

tabletableTimeyears

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock