Question: Rock Industries allocates manufacturing overhead based on direct labor cost. Any overallocated or underallocated overhead is closed monthly. The annual budget shows Direct Labor costs

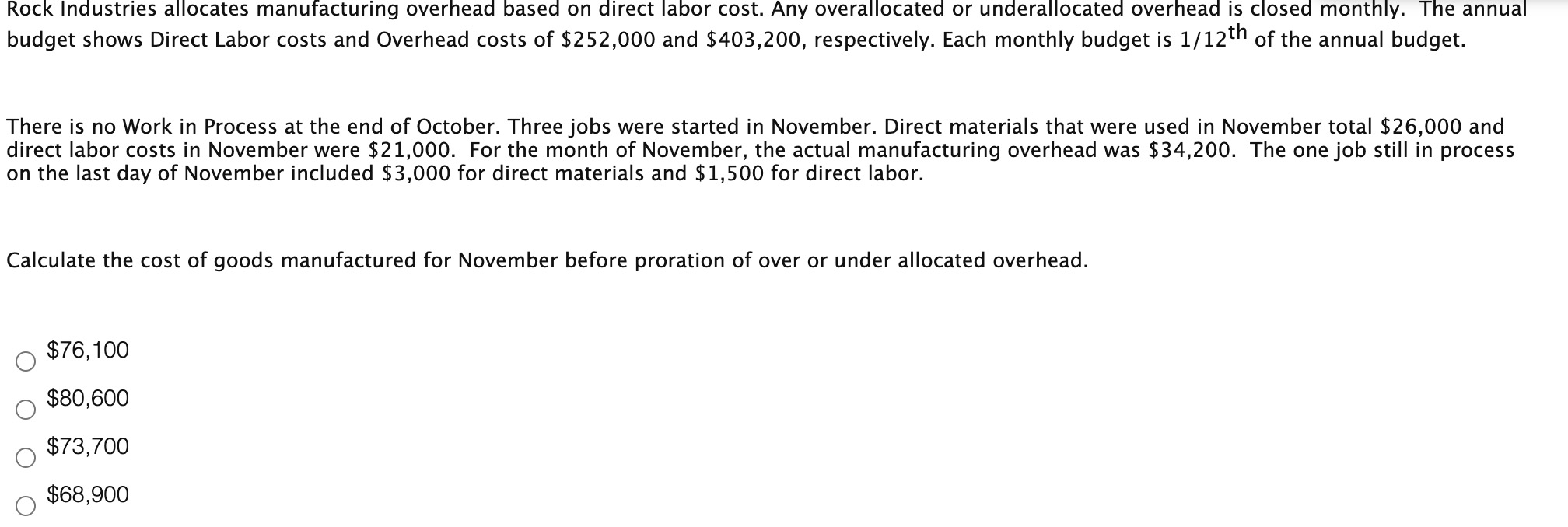

Rock Industries allocates manufacturing overhead based on direct labor cost. Any overallocated or underallocated overhead is closed monthly. The annual budget shows Direct Labor costs and Overhead costs of $252,000 and $403,200, respectively. Each monthly budget is 1/12th of the annual budget. There is no Work in Process at the end of October. Three jobs were started in November. Direct materials that were used in November total $26,000 and direct labor costs in November were $21,000. For the month of November, the actual manufacturing overhead was $34,200. The one job still in process on the last day of November included $3,000 for direct materials and $1,500 for direct labor. Calculate the cost of goods manufactured for November before proration of over or under allocated overhead. $76,100 $80,600 $73,700 $68,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts