Question: Roger has a small convenience store with three employees. Each of the employees earns $10 per hour and they each work approximately 1, 500 hours

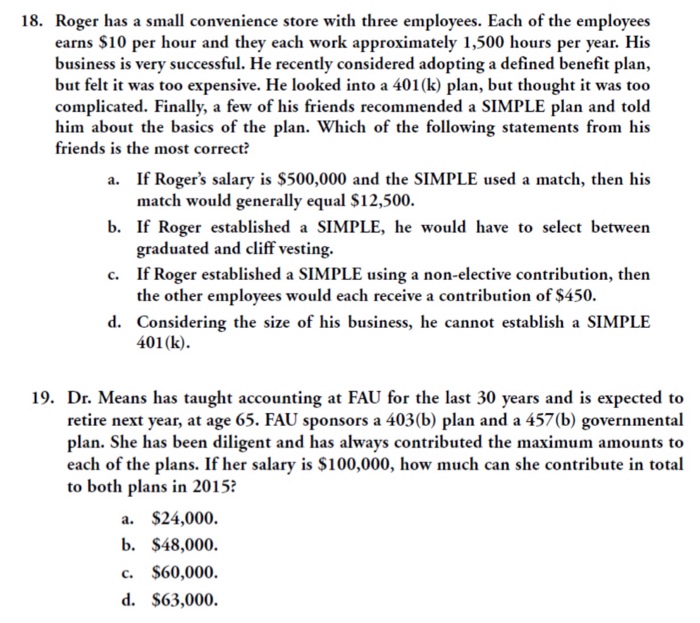

Roger has a small convenience store with three employees. Each of the employees earns $10 per hour and they each work approximately 1, 500 hours per year. His business is very successful. He recently considered adopting a defined benefit plan, but felt it was too expensive. He looked into a 401 (k) plan, but thought it was too complicated. Finally, a few of his friends recommended a SIMPLE plan and told him about the basics of the plan. Which of the following statements from his friends is the most correct? If Rogers salary is $500,000 and the SIMPLE used a match, then his match would generally equal $12, 500. If Roger established a SIMPLE, he would have to select between graduated and cliff vesting. If Roger established a SIMPLE using a non-elective contribution, then the other employees would each receive a contribution of $450. Considering the size of his business, he cannot establish a SIMPLE 401 (k). Dr. Means has taught accounting at FAU for the last 30 years and is expected to retire next year, at age 65. FAU sponsors a 403(b) plan and a 457(b) governmental plan. She has been diligent and has always contributed the maximum amounts to each of the plans. If her salary is $100,000, how much can she contribute in total to both plans in 2015? $24,000. $48,000. $60,000. $63,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts