Question: Roger is considering adding toys to his general store. He estimates that the cost of inventory will be $6,400. The remodeling expenses and shelving costs

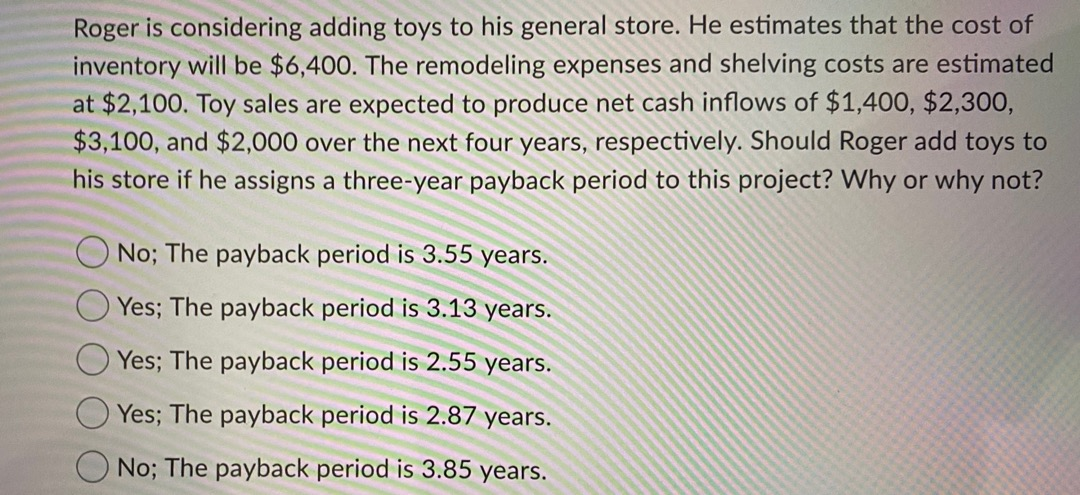

Roger is considering adding toys to his general store. He estimates that the cost of inventory will be $6,400. The remodeling expenses and shelving costs are estimated at $2,100. Toy sales are expected to produce net cash inflows of $1,400, $2,300, $3,100, and $2,000 over the next four years, respectively. Should Roger add toys to his store if he assigns a three-year payback period to this project? Why or why not? O No; The payback period is 3.55 years. Yes; The payback period is 3.13 years. Yes; The payback period is 2.55 years. Yes; The payback period is 2.87 years. No; The payback period is 3.85 years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock