Question: Rogers Printing Ltd. has contracts to complete weekly supplements required by its' customers. For the current year, manufacturing overhead cost estimates total $580,000 for an

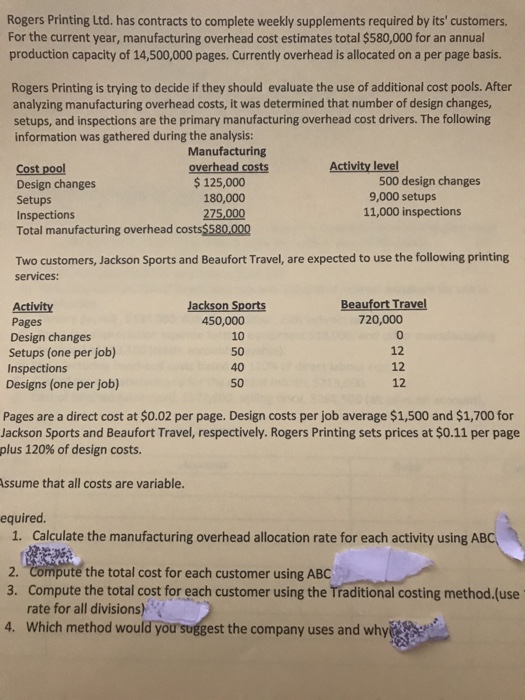

Rogers Printing Ltd. has contracts to complete weekly supplements required by its' customers. For the current year, manufacturing overhead cost estimates total $580,000 for an annual production capacity of 14,500,000 pages. Currently overhead is allocated on a per page basis. Rogers Printing is trying to decide if they should evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis: Manufacturing overhead costs Activity level Cost Design changes Setups Inspections Total manufacturing overhead costs$580,000 125,000 180,000 275,000 500 design changes 9,000 setups 11,000 inspections Two customers, Jackson Sports and Beaufort Travel, are expected to use the following printing services: Jackson Sports Beaufort Travel Activity Pages Design changes Setups (one per job) 450,000 10 50 40 50 720,000 0 12 12 12 Inspections Designs (one per job) Pages are a direct cost at $0.02 per page. Design costs per job average $1,500 and $1,700 for Jackson Sports and Beaufort Travel, respectively. Rogers Printing sets prices at $0.11 per page plus 120% of design costs. Assume that all costs are variable equired 1. Calculate the manufacturing overhead allocation rate for each activity using ABC 2Pompute the total cost for each customer using ABC 3. Compute the total cost for each customer using the Traditional costing method.(use rate for all divisions. ' 4. Which method would you suggest the company uses and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts