Question: Rogot Instruments makes fine violins and cellos. It has $1.6 million in debt outstanding, equity valued at $2.3 million and pays corporate income tax at

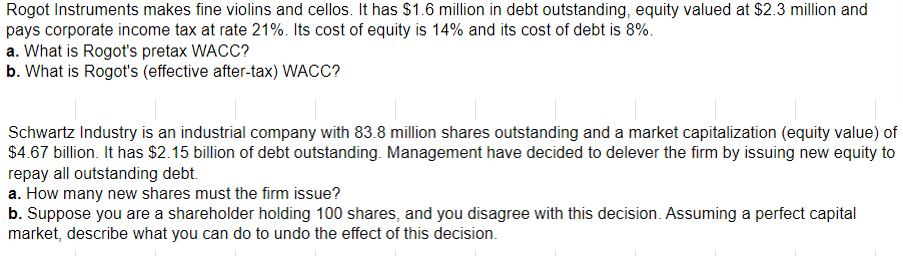

Rogot Instruments makes fine violins and cellos. It has $1.6 million in debt outstanding, equity valued at $2.3 million and pays corporate income tax at rate 21%. Its cost of equity is 14% and its cost of debt is 8% a. What is Rogot's pretax WACC? b. What is Rogot's (effective after-tax) WACC? Schwartz Industry is an industrial company with 83.8 million shares outstanding and a market capitalization (equity value) of $4.67 billion. It has $2.15 billion of debt outstanding. Management have decided to delever the firm by issuing new equity to repay all outstanding debt. a. How many new shares must the firm issue? b. Suppose you are a shareholder holding 100 shares, and you disagree with this decision. Assuming a perfect capital market, describe what you can do to undo the effect of this decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts