Question: Rogot Instruments makes fine violins and cellos. It has $1.8 million in debt outstanding, equity valued at $2.5 million, and pays corporate income tax

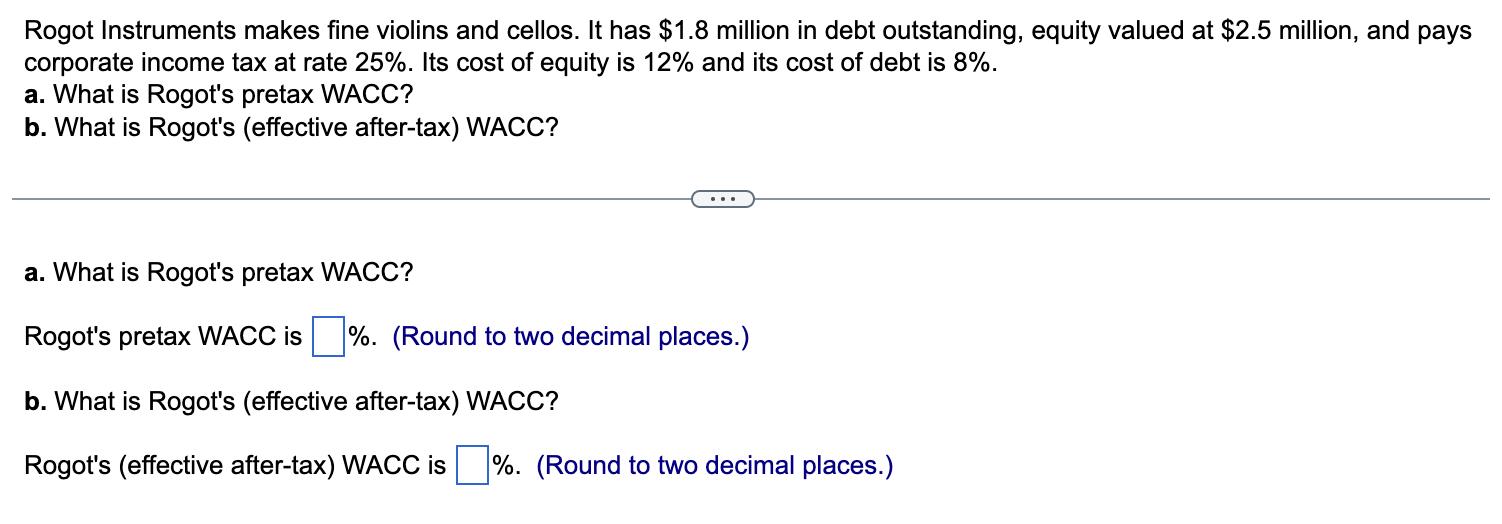

Rogot Instruments makes fine violins and cellos. It has $1.8 million in debt outstanding, equity valued at $2.5 million, and pays corporate income tax at rate 25%. Its cost of equity is 12% and its cost of debt is 8%. a. What is Rogot's pretax WACC? b. What is Rogot's (effective after-tax) WACC? a. What is Rogot's pretax WACC? Rogot's pretax WACC is %. (Round to two decimal places.) b. What is Rogot's (effective after-tax) WACC? Rogot's (effective after-tax) WACC is %. (Round to two decimal places.)

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

a Pret ax W ACC Deb t x Cost of Debt x 1 Tax Rate Equ ity x Cost of Equity 1 8 M x 8 x 1 25 2 5 ... View full answer

Get step-by-step solutions from verified subject matter experts