Question: Rogue River, Inc. is considering a project that has an initial after-tax outlay or after-tax cost of $220,000. The respective future cash inflows from its

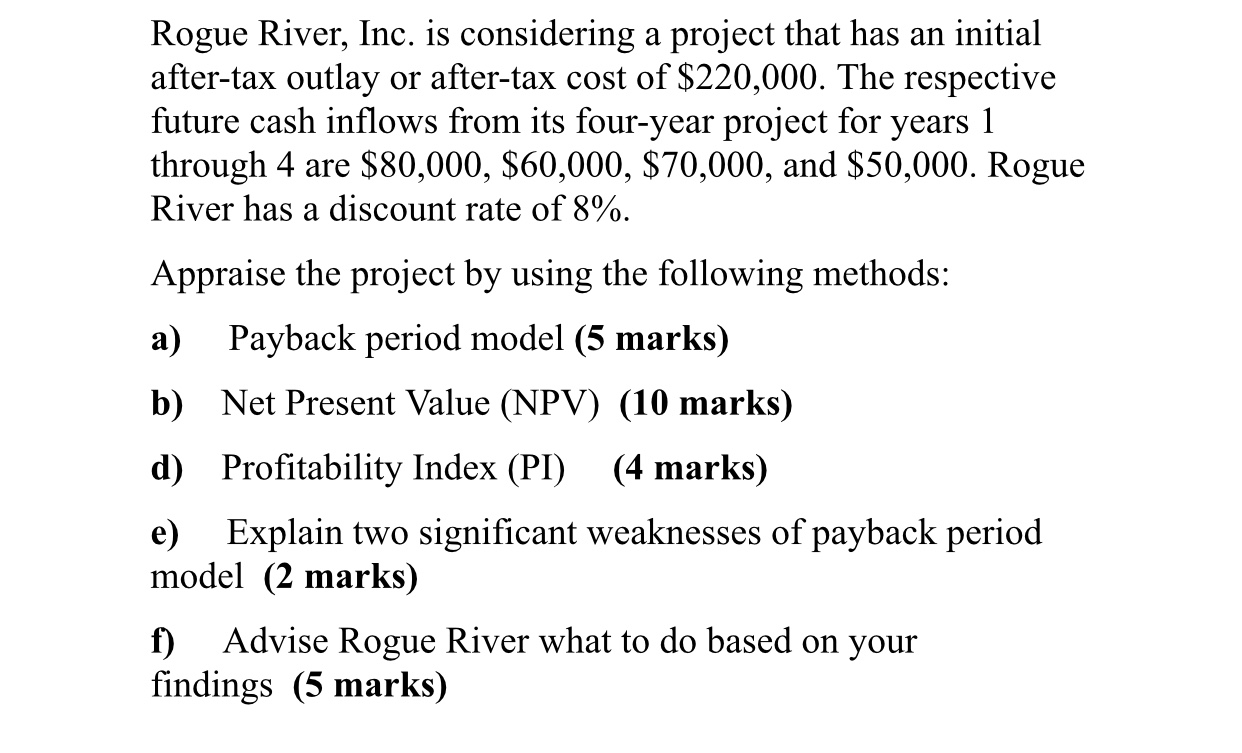

Rogue River, Inc. is considering a project that has an initial after-tax outlay or after-tax cost of $220,000. The respective future cash inflows from its four-year project for years 1 through 4 are $80,000,$60,000,$70,000, and $50,000. Rogue River has a discount rate of 8%. Appraise the project by using the following methods: a) Payback period model (5 marks) b) Net Present Value (NPV) (10 marks) d) Profitability Index (PI) (4 marks) e) Explain two significant weaknesses of payback period model (2 marks) f) Advise Rogue River what to do based on your findings

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock