Question: roject - 1 0 0 points Saved After the success of the company's first two months, Santana Rey continues to operate Business Solutions. The November

roject points

Saved

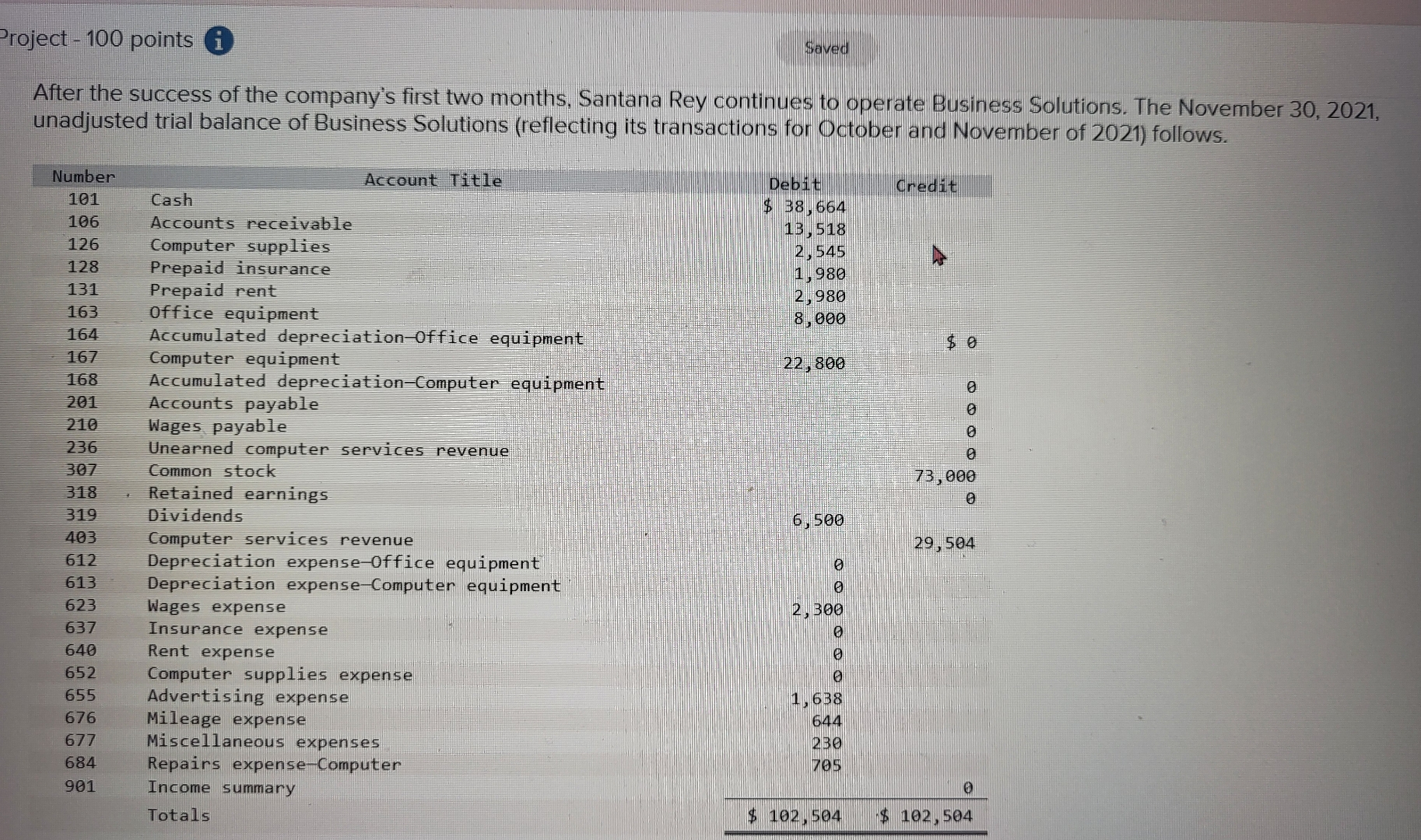

After the success of the company's first two months, Santana Rey continues to operate Business Solutions. The November unadjusted trial balance of Business Solutions reflecting its transactions for October and November of follows.

tableNumberAccount Title,Debit,CreditCash,$ Accounts receivable,Computer supplies,Prepaid insurance,Prepaid rent,Office equipment,Accumulated depreciationOffice equipment,,$ Computer equipment,Accumulated depreciationComputer equipment,,Accounts payable,,Wages payable,,Unearned computer services revenue,,Common stock,,Retained earnings,,Dividends,Computer services revenue,,Depreciation expenseOffice equipment,Depreciation expenseComputer equipment,Wages expense,Insurance expense,Rent expense,Computer supplies expense,Advertising expense,Mileage expense,Miscellaneous expenses,Repairs expenseComputer,Income summary,,Totals,$ $

Business Solutions had the following transactions and events in December December Paid $ cash to Hillside Mall for Business Solutions's share of mall advertising costs.December Paid $ cash for minor repairs to the company's computer.December Received $ cash from Alex's Engineering Company for the receivable from November.December Paid cash to lyn Addie for six days of work at the rate of $ per day.December Notified by Alex's Engineering Company that Business Solutions's bid $ on a proposed project has beenaccepted. Alex's paid a $ cash advance to Business Solutions.December Purchased $ of computer supplies on credit from Harris office Products.December Sent a reminder to Gomez Company to pay the fee for services recorded on November December Completed a project for Liu Corporat ion and received $ cash.December Took the week off for the holidays.December Received $B cash from Gomez Company on its receivable.December Reimbursed S Rey for business automobi le mileage miles at se per mileDecember Paid $ cash for dividends.The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for thecompany's first three months.a The December inventory count of computer supplies shows $ still available.b Three months have expired since the month insurance premium was paid in advance.c As of December Lyn Addie has not been paid for four days of work at $ per day.d The computer system, acquired on October is expected to have a fouryear life with no salvage value.e The office equipment, acquired on October is expected to have a fiveyear life with no salvage value.f Three of the four months' prepaid rent have expired.Required: Prepare journal entries to record each of the December transactions. Post those entries to the accounts in the ledgera Prepare adjusting entries to reflect a through fb Post the journal entries to record each of the December transactions, adjusting entries to the accounts in the ledger Prepare an adusted trial balance as of December Prepare an income statement for the three months ended December Prepare a statement of retained earnings for the three months ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock