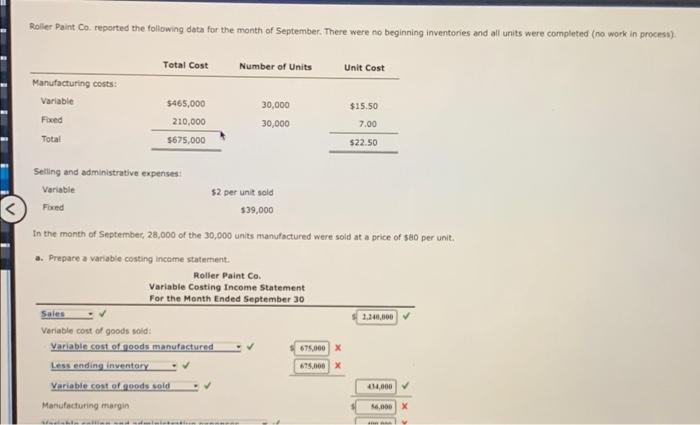

Question: Roller Paint Co. reported the following data for the month of September. There were no beginning inventories and all units were completed (no work in

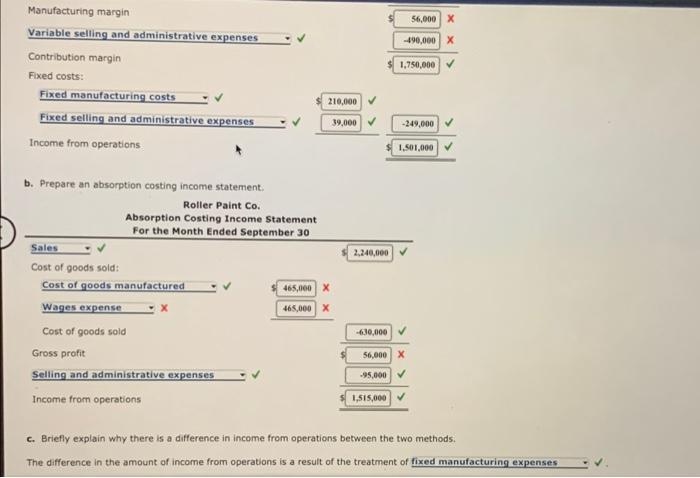

Roller Paint Co. reported the following data for the month of September. There were no beginning inventories and all units were completed (no work in process). Total Cost Number of Units Unit Cost Manufacturing costs: Variable Foxed 5465,000 210,000 $675,000 30,000 30,000 $15.50 7.00 Total $22.50 Selling and administrative expenses: Variable $2 per unit sold Foxed $39,000 In the month of September, 28,000 of the 30,000 units manufactured were sold at a price of seo per unit. a. Prepare a variable costing income statement Roller Paint Co. Variable Costing Income Statement For the Month Ended September 30 Sales 2.240.000 Variable cost of goods sold Variable cost of goods manufactured 675.000 x Less ending inventory 695.000 X Variable cost of goods sold 34.000 Manufacturing margin - $6.000 56,000 X -490,000 X 1,750,000 Manufacturing margin Variable selling and administrative expenses Contribution margin Fixed costs: Fixed manufacturing costs Fixed selling and administrative expenses Income from operations 210,000 39,000 -249,000 1.500.000 2,240,000 b. Prepare an absorption costing income statement Roller Paint Co. Absorption Costing Income Statement For the Month Ended September 30 Sales Cost of goods sold: Cost of goods manufactured 465,000 X Wages expense 465,000 x Cost of goods sold Gross profit Selling and administrative expenses Income from operations -630,000 56,000 X -95,000 1,515,000 C. Briefly explain why there is a difference in income from operations between the two methods. The difference in the amount of income from operations is a result of the treatment of fixed manufacturing expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts