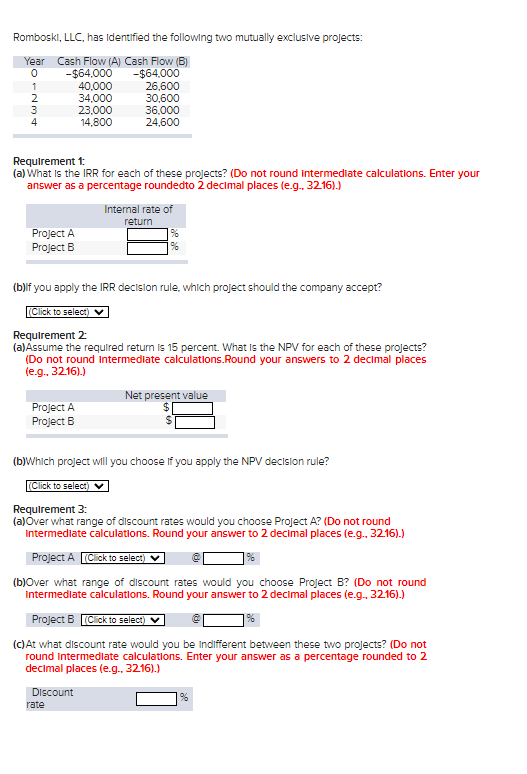

Question: Romboski, LLC, has Identified the following two mutually exclusive projects: Requirement 1: (a) What is the IRR for each of these projects? (Do not round

Romboski, LLC, has Identified the following two mutually exclusive projects: Requirement 1: (a) What is the IRR for each of these projects? (Do not round intermedlate calculations. Enter your answer as a percentage roundedto 2 decimal places (e.g., 3216).) (b)If you apply the IRR decision rule, which project should the company accept? Requirement 2: (a) Assume the required return is 15 percent. What is the NPV for each of these projects? (Do not round intermediate calculations.Round your answers to 2 declmal places (e.g. 32.16).) (b)Which project will you choose if you apply the NPV decision rule? Requirement 3 : (a)Over what range of discount rates would you choose Project A? (Do not round intermedlate calculations. Round your answer to 2 decimal places (e.g.. 32.16).) @% (b)Over what range of discount rates would you choose Project B? (Do not round Intermedlate calculations. Round your answer to 2 decimal places (e.g. 3216).) @ % (c) At what discount rate would you be indlfferent between these two projects? (Do not round intermedlate calculatlons. Enter your answer as a percentage rounded to 2 decimal places (e.g., 3216).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts