Question: Ron Arthur has a Personal Auto Policy with liability limits of $100/300/50; comprehensive and collision coverage ($500 deductible): Transportation Expense ($30 daily/$900 aggregate;medical payments ($5,000)

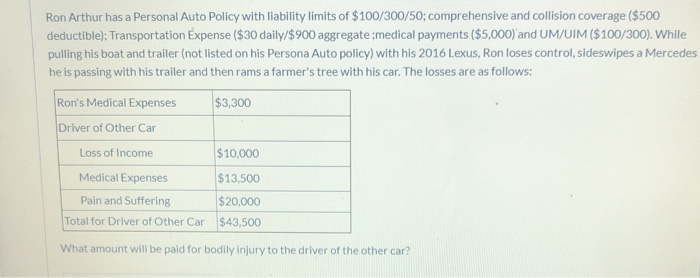

Ron Arthur has a Personal Auto Policy with liability limits of $100/300/50; comprehensive and collision coverage ($500 deductible): Transportation Expense ($30 daily/$900 aggregate;medical payments ($5,000) and UM/UIM ($100/300). While pulling his boat and trailer (not listed on his Persona Auto policy) with his 2016 Lexus, Ron loses control, sideswipes a Mercedes he is passing with his trailer and then rams a farmer's tree with his car. The losses are as follows: Ron's Medical Expenses $3,300 Driver of Other Car Loss of Income Medical Expenses Pain and Suffering Total for Driver of Other Car $10,000 $13,500 $20,000 $43,500 What amount will be paid for bodily injury to the driver of the other car

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts