Question: Ron needs to save $40,000 for a down payment on his new house. He needs this money in 3 years. Ron is planning on

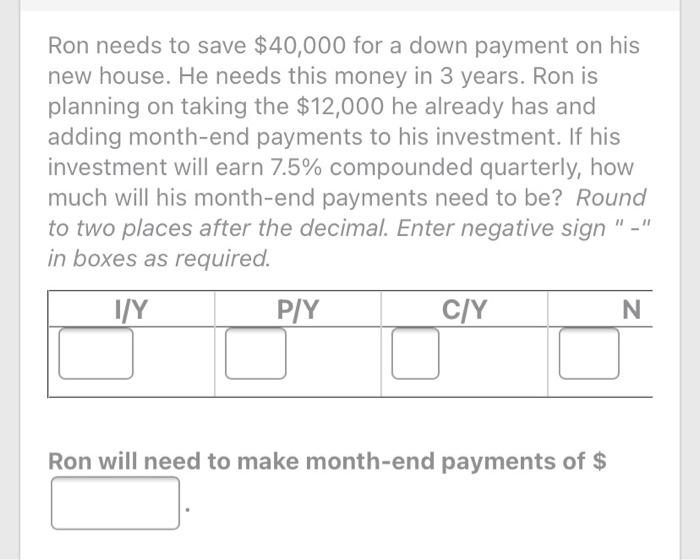

Ron needs to save $40,000 for a down payment on his new house. He needs this money in 3 years. Ron is planning on taking the $12,000 he already has and adding month-end payments to his investment. If his investment will earn 7.5% compounded quarterly, how much will his month-end payments need to be? Round to two places after the decimal. Enter negative sign "-" in boxes as required. I/Y P/Y C/Y N Ron will need to make month-end payments of $

Step by Step Solution

3.54 Rating (175 Votes )

There are 3 Steps involved in it

Future volue 40 000 12000 i i Pmt iti 40000 20 20 1... View full answer

Get step-by-step solutions from verified subject matter experts