Question: ront Paragraph Select Styles Editing Voice Editor Add - ins information pertaining to their activight - year - old son, Jorge, from his previous marriage.

ront

Paragraph

Select

Styles

Editing

Voice

Editor

Addins

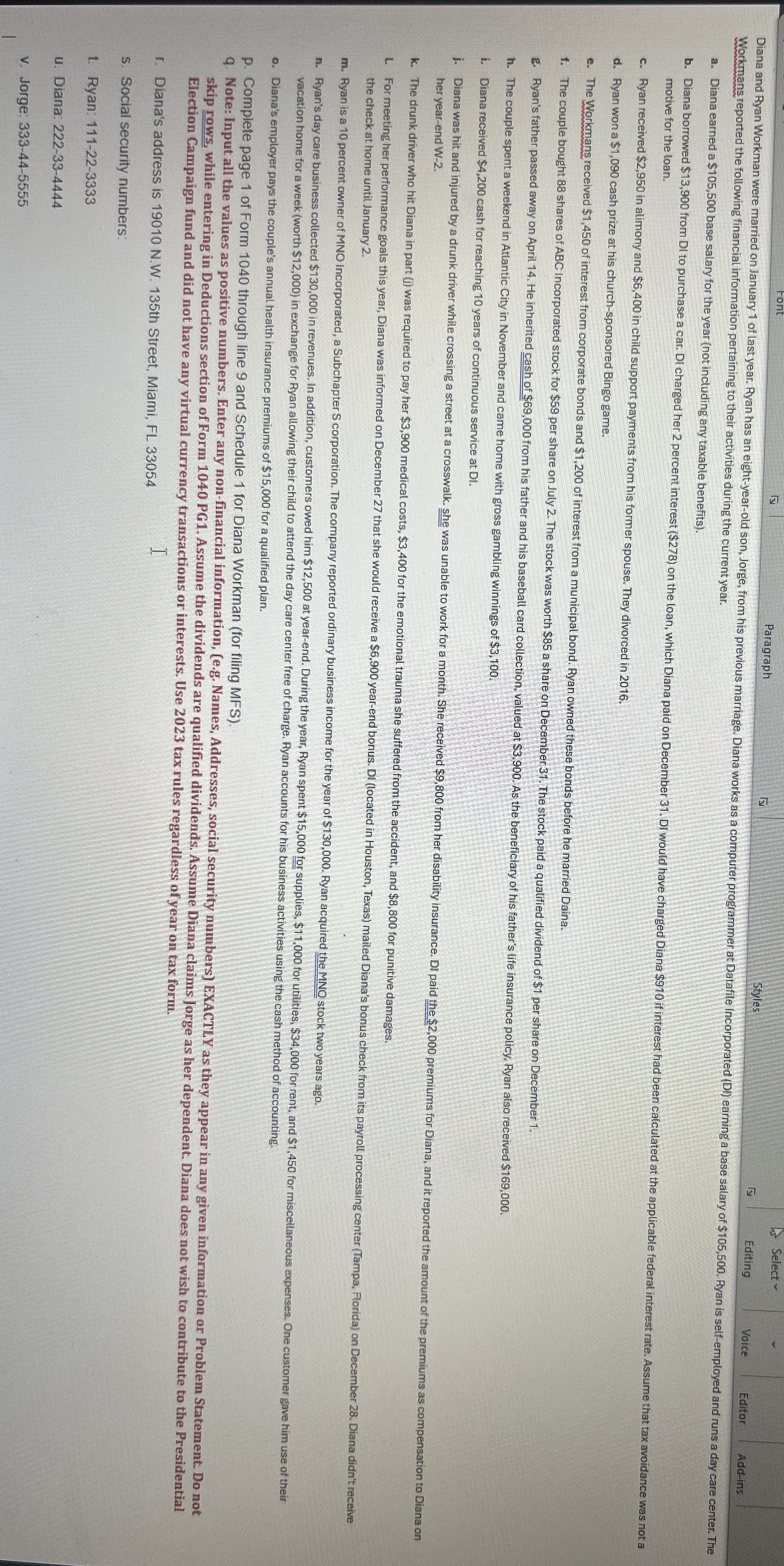

information pertaining to their activightyearold son, Jorge, from his previous marriage. Diana works as a computer programmer at Datafile incorporated DI earning a base salary of $ Fyan is selfemployed and runs a day care center. The

a Diana earned a $ base salary for the year not including any taxable benefits motive for the loan.

c Ryan received $ in alimony and $ in child support payments from his former spouse. They divorced in

d Ryan won a $ cash prize at his churchsponsored Bingo game.

e The Workmans received $ of interest from corporate bonds and $ of interest from a municipal bond. Ryan owned these bonds before he married Daina.

f The couple bought shares of ABC Incorporated stock for $ per share on July The stock was worth $ a share on December The stock paid a qualified dividend of $ per share on December

g Ryan's father passed away on April He inherited cash of $ from his father and his baseball card collection, velued at $ As the beneficiary of his father's life insurance policy, Ryan also received $

h The couple spent a weekend in Atlantic City in November and came home with gross gambling winnings of $

i Diana received $ cash for reaching years of continuous service at DI her yearend W

k The drunk driver who hit Diana in part j was required to pay her $ medical costs, $ for the emotional trauma she suffered from the accident, and $ for punitive damages. the check at home until January

m Ryan is a percent owner of MNO Incorporated, a Subchapter S corporation. The company reported ordinary business income for the year of $ Ryan acquired the MNO stock two years ago. vacation home for a week worth $ in exchange for Ryan allowing their child to attend the day care center free of charge. Ryan accounts for his business activities using the cash method of accounting.

o Diana's employer pays the couple's annual health insurance premiums of $ for a qualified plan.

p Complete page of Form through line and Schedule for Diana Workman for filing MFS Election Campaign fund and did not have any virtual currency transactions or interests. Use tax rules regardless of year on tax form.

r Diana's address is NWth Street, Miami, FL

s Social security numbers:

t Ryan:

u Diana:

v Jorge:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock