Question: Rose dies with passive activity property having an adjusted basis of $185,200, suspended losses of $59,264, and a fair market value at the date of

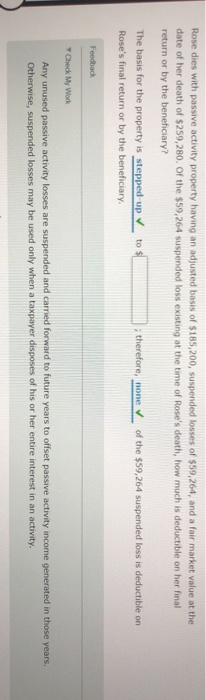

Rose dies with passive activity property having an adjusted basis of $185,200, suspended losses of $59,264, and a fair market value at the date of her death of $259,280. Of the $59,264 suspended loss existing at the time of Rose's death, how much is deductible on her final return or by the beneficiary? to $ therefore, none of the $59,264 suspended loss is deductible on The basis for the property is stepped up Rose's final return or by the beneficiary. Feedback Check My Work Any unused passive activity losses are suspended and cared forward to future years to offset passive activity income generated in those years. Otherwise, suspended losses may be used only when a taxpayer disposes of his or her entire interest in an activity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts