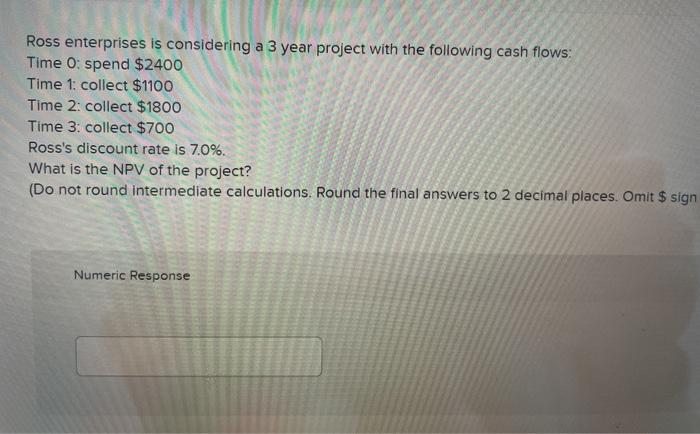

Question: Ross enterprises is considering a 3 year project with the following cash flows: Time 0: spend $2400 Time 1: collect $1100 Time 2: collect $1800

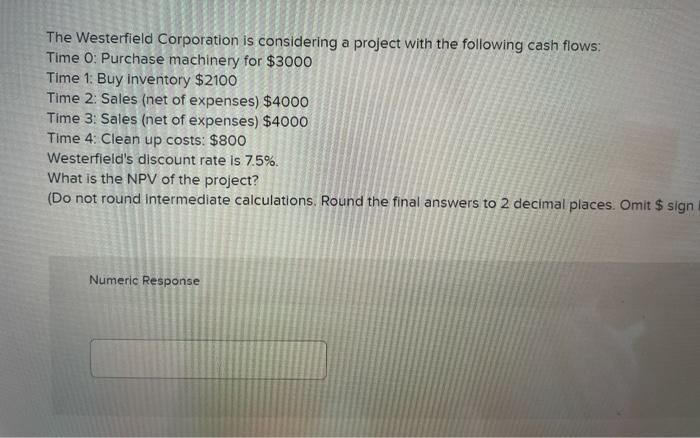

Ross enterprises is considering a 3 year project with the following cash flows: Time 0: spend $2400 Time 1: collect $1100 Time 2: collect $1800 Time 3: collect $700 Ross's discount rate is 70%. What is the NPV of the project? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign Numeric Response The Westerfield Corporation is considering a project with the following cash flows: Time 0: Purchase machinery for $3000 Time 1: Buy inventory $2100 Time 2: Sales (net of expenses) $4000 Time 3: Sales (net of expenses) $4000 Time 4: Clean up costs: $800 Westerfield's discount rate is 7.5%. What is the NPV of the project? (Do not round intermediate calculations, Round the final answers to 2 decimal places. Omit $ sign Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts