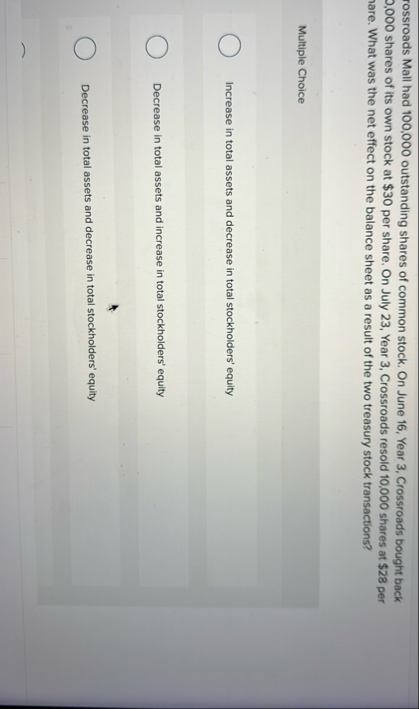

Question: rossroads Mall had 1 0 0 , 0 0 0 outstanding shares of common stock. On June 1 6 , Year 3 , Crossroads bought

rossroads Mall had outstanding shares of common stock. On June Year Crossroads bought back shares of its own stock at $ per share. On July Year Crossroads resold shares at $ per hare. What was the net effect on the balance sheet as a result of the two treasury stock transactions?

Multiple Choice

Increase in total assets and decrease in total stockholders' equity

Decrease in total assets and increase in total stockholders' equity

Decrease in total assets and decrease in total stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock