Question: ROTECTOR COITETUT the work you have completed so far. It does not in Required information UMY 3. Compute the first-year depreciation expense on the land

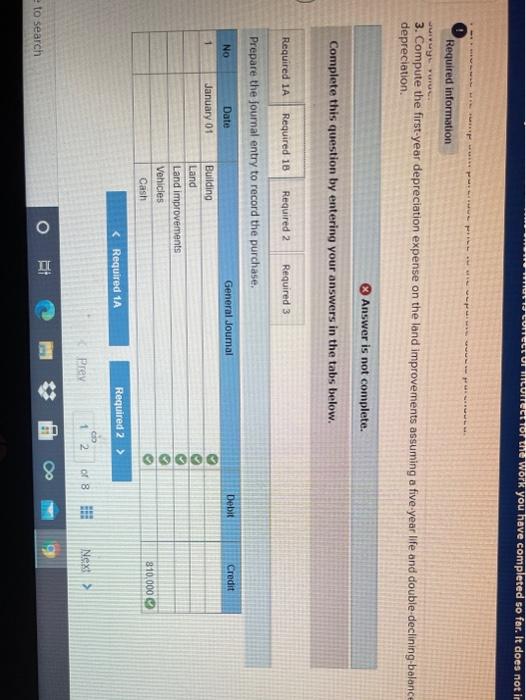

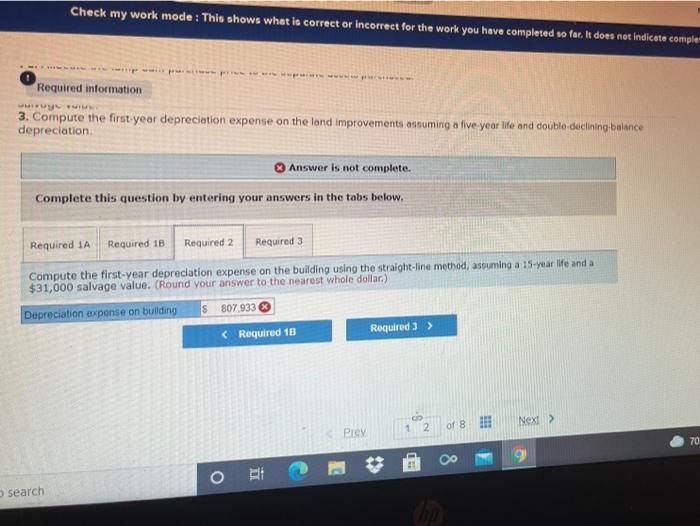

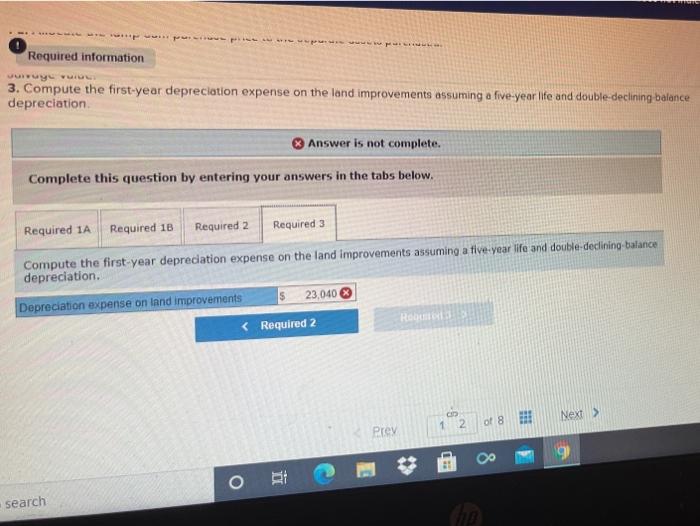

ROTECTOR COITETUT the work you have completed so far. It does not in Required information UMY 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double declining balance depreciation. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required Prepare the Journal entry to record the purchase. No Date General Joumal Debit Credit January 01 Building Land Land improvements Vehicles Cash ooooo 810,000 Prey 12 O 8 Next > O RE to search $ Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicato comple" wp- Required information suyu 3. Compute the first-year depreciation expense on the land improvements assuming a five year and double declining balance depreciation Answer is not complete Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $31,000 salvage value. (Round your answer to the nearest whole dollar.) Depreciation expense on building IS 807.933 of 8 Next > 1 2 Prey 70 8 ORI search pop Required information wir y vo 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Compute the first year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation 23.040 83 Depreciation expense on land improvements ROS Required 2 Next > 1 2 of 8 Prev o search The ROTECTOR COITETUT the work you have completed so far. It does not in Required information UMY 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double declining balance depreciation. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required Prepare the Journal entry to record the purchase. No Date General Joumal Debit Credit January 01 Building Land Land improvements Vehicles Cash ooooo 810,000 Prey 12 O 8 Next > O RE to search $ Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicato comple" wp- Required information suyu 3. Compute the first-year depreciation expense on the land improvements assuming a five year and double declining balance depreciation Answer is not complete Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $31,000 salvage value. (Round your answer to the nearest whole dollar.) Depreciation expense on building IS 807.933 of 8 Next > 1 2 Prey 70 8 ORI search pop Required information wir y vo 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Compute the first year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation 23.040 83 Depreciation expense on land improvements ROS Required 2 Next > 1 2 of 8 Prev o search The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts