Question: rou ose re E7.2. Reverse Engineering Expected Returns (Easy) a. A share traded at $26 at the end of 2012 with a price-to-book ratio of

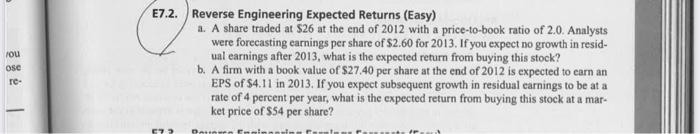

rou ose re E7.2. Reverse Engineering Expected Returns (Easy) a. A share traded at $26 at the end of 2012 with a price-to-book ratio of 2.0. Analysts were forecasting earnings per share of $2.60 for 2013. If you expect no growth in resid- ual earnings after 2013, what is the expected return from buying this stock? b. A firm with a book value of $27.40 per share at the end of 2012 is expected to earn an EPS of $4.11 in 2013. If you expect subsequent growth in residual carnings to be at a rate of 4 percent per year, what is the expected return from buying this stock at a mar- ket price of $54 per share? nad

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts