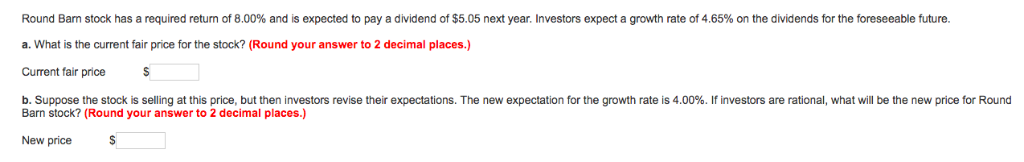

Question: Round Bar stock has a required return o 8.00% and s expected to pay a dividend of $5.05 next year. nvestors expect a growth rate

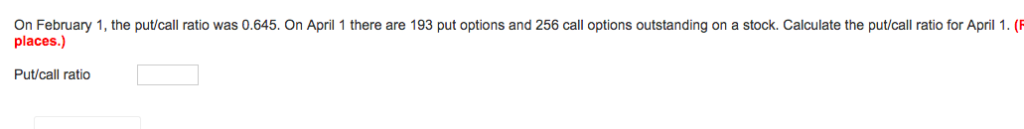

Round Bar stock has a required return o 8.00% and s expected to pay a dividend of $5.05 next year. nvestors expect a growth rate 01465%, on the di den for theforeseeable uture a. What is the current fair price for the stock? (Round your answer to 2 decimal places.) Current fair price b. Suppose the stock is selling at this price, but then investors revise their expectations. The new expectation for the growth rate is 4.00% if investors are rational hat ill be the new price for Round Barn stock? (Round your answer to 2 decimal places.) New price On February 1, the put/call ratio was 0.645. On April 1 there are 193 put options and 256 call options outstanding on a stock. Calculate the put/call ratio for April 1 (f places.) Put/call ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts